Does Supporting the Zoo Require Increased Funding and Reduced Accountability? A Review of the Proposed “Continuing” Levy

Apr 25, 2014

By Joe Nichols

Summary

On May 6th, Franklin County voters will decide whether to approve or reject a continuing property tax levy increase for the Columbus Zoo and Aquarium. The proposal raises three serious issues for voters to consider: 1) whether a continuing (often referred to as permanent) levy is necessary to support the zoo, or whether the current use of temporary (no more than 10-year) levies provide adequate support while retaining greater accountability; 2) whether it is fair for taxpayers in Franklin County alone to shoulder the increased property tax burden when the zoo is located in Delaware County; and 3) whether significantly increasing taxes for the addition of a satellite zoo in downtown Columbus is necessary in light of the existing world-class zoo facility just up the road.

In Columbus, we are rightly proud of our zoo and of “Jungle” Jack Hanna. However, a review of the proposed levy increase, the history of the Columbus Zoo’s levies, and the funding streams for other premier zoos across the country indicates that Franklin County residents can maintain our exceptional zoo without increasing the tax burden on Franklin County alone or making that increase permanent.

Background

Franklin County homeowners currently pay property tax to the zoo at a rate of 0.75 mills, for an annual cost of $21.29 per $100,000 of home value.[1] The proposed rate hike to 1.25 mills would more than double this amount to $43.75 per $100,000 home value.[2] While the millage would increase by 66 percent, the actual amount paid would increase by 105 percent. This discrepancy is the result of the 10 and 2.5 percent property tax rollbacks, which have been in place for decades, no longer being applied to new levies.[3] Thus, an owner of a median-priced home would pay an additional $32 per year to the zoo alone if the levy passes.[4]

The existing levy gives the zoo approximately $18 million per year. The proposed higher rate would yield upwards of $32.5 million per year for the zoo.[5] The zoo claims that it would use this sizeable increase to facilitate long-term planning and investments, cushion its operating budget, and construct a satellite zoo downtown at the Veterans Memorial location.

The median effective millage rate for Franklin County homes has grown by 24.55 mills in the past ten years.[6] These increases have hiked the total county property tax bill for the owner of a median-priced home from approximately $2,600.00 during the 2004 tax year to over $3,800.00 in the present year.[7]

Recent tax changes in Ohio only worsen the situation. These changes include the 2009 Columbus municipal income tax increase from 2 to 2.5 percent, the recent state sales tax increase from 5.5 percent to 5.75 percent, and the subsequent increase in the Franklin County sales tax from 0.75 percent to 1.25 percent. Multiple school levies are also likely, including another inevitable attempt by Columbus City Schools after their recent failure to secure a proposed 9.01 mill increase. When factoring in the Central Ohio Transit Authority’s combined 0.5 percent tax, Franklin County taxpayers accumulate the second highest total sales tax burden in the state at 7.5 percent.[8]

In fact, the 2012 Tax Rates and Tax Burdens report issued by the Financial Office of the District of Columbia ranks Columbus as the 5th highest-taxed city in the United States for middle- income households.[9] There is no doubt that Franklin County is overtaxed. With each new or increased tax, we make Franklin County less attractive to new residents and businesses.[10]

Columbus Zoo Organization and Finance

Zoo levy funds are managed by the Columbus Zoological Park Association, a 501(c)(3) non- pro t umbrella for the Columbus Zoo and Aquarium, The Wilds (a 10,000 acre preserve in Muskingum County), the Safari Golf Course, and the Zoombezi Bay water park (a for-profit C Corporation).[11] Altogether the Association received over $61 million in revenues in 2012.[12] The single largest revenue source was $17.8 million from the Franklin County levy.[13]

Total compensation for all employees grew from $16 million in 2003 to $25.2 million in 2012, while its top executives’ salaries increased from a combined $1.0 million to $1.75 million over the same time.[14] The zoo’s full-time employees are all eligible for public retirement packages through the Ohio Public Employees Retirement System, and approximately 40 percent of them are unionized.[15]

The funding stream for the Columbus Zoo is secure. The current levy is in effect until 2015, and should the proposed levy fail, the current levy would remain in effect, and could be extended as soon as this fall.[16]

Comparison of Zoo Financing

This organizational structure, where a city or county relinquishes management to a non-profit zoological society, is common today and seems favorable for the community. However, receiving approximately one third of operating revenues from local property taxes is not nearly as common for zoos under this arrangement.

| Zoo | Adult Ticket | Child Ticket | Family of 4 Membership | Parking | Property Levy Per $100,000 Value |

| Columbus | $15 | $9.99 | $99 | $8 | $21 ($44 Proposed) |

| Phoenix | $20 | $10 | $170 | $0 | $0 |

| St. Louis | $0 | $0 | $0 | $15 | $76.90 |

| Omaha | $15 | $10 | $94 | $0 | $0 |

| San Diego | $46 | $36 | $217 | $0 | $5 |

For example, the Phoenix Zoo—one of the top zoos in the country—receives no consistent taxpayer funding. The Phoenix Zoo relied on memberships and admissions, grants, and fundraising activities to fund its operations, although for a recent capital fundraising drive, it did receive a limited amount of funds from the city through a small, one-time bond contribution.[17]

Many other premier zoological associations receive significantly less public funding than the Columbus Zoo does currently, let alone under the proposed higher levy. Omaha’s Henry Doorly Zoo—a perennial competitor with Columbus for best zoo rankings—receives Keno gambling dollars rather than property taxes, amounting to just 5 percent of total revenues.[18]

The renowned San Diego Zoo benefits from local property taxes, but these only amount to $5 per year per $100,000 in property value[19] and provide a mere 4 percent of its total annual revenue.[20] St. Louis city and county residents pay $76.90 per $100,000 of property value annually for the zoo, but visitors to the St. Louis zoo pay nothing at the door.[21]

Cities fund top-ranking zoos on a sliding scale of taxpayer support. The Columbus Zoo is near the middle of the pack in total costs, but supports these costs with more property tax dollars than most other leading national zoos reviewed. While some of the zoos with less taxpayer support may have higher admission or membership fees, this user-fee model has the advantage of internalizing the costs to those who receive the direct bene t of “using” the zoo.

A “Permanent” Levy

Franklin County’s already high tax burden requires prudent voters to question the structure and necessity of a request for another tax increase—particularly one as sizable as the zoo levy. Prior to a recent change in the law, zoo levies could only be imposed for a maximum of 10 years. With the recent removal of this restriction, the proposed zoo levy will be a continuing levy, recurring indefinitely into the future rather than sunsetting after a fixed term of years. With no expiration date, the need to place the issue on the ballot periodically in order to maintain accountability to taxpayers will be eliminated.

Presently, if voters think that the zoo is not managing its funds well, or is failing to meet the public’s wants and needs, they may refuse to pass any further levies. Under the proposed continuing levy, it becomes significantly more difficult for taxpayers to hold the zoo accountable for its management of the funds. As the table to the right shows, Franklin County residents have been very supportive of the zoo since 1985, when the City of Columbus ceased supporting it with general fund revenues and shifted the burden to homeowners.[22] Given the historical generosity of Franklin County residents, removing the accountability of levy renewals is both unnecessary and limits legitimate taxpayer oversight.

| Year | Millage |

| 1985 | 0.25 |

| 1990 | 0.50 |

| 1994 | 0.75 |

| 2004 | 0.75 |

| 2014 | 1.25? |

As a continuing levy, the increased tax will be tremendously cumbersome to reduce, should taxpayers wish to do so in the future. Ohio law would require taxpayers seeking to reduce the levy to collect a large number of signatures—equal to 10 percent of all Franklin County residents who voted in the previous gubernatorial election—to qualify for the ballot. Such a qualifying attempt can only be made once every five years.[23] Furthermore, this onerous method permits voters to seek only to reduce a levy, not to repeal or eliminate it.[24]

Fairness to Franklin County

Only Franklin County residents bear the burden of property taxes for the zoo, even though the zoo is located in Delaware County. This anomaly originated when the City of Columbus moved the zoo from downtown to land it owns near Powell about 50 years ago. The Association took over management in 1970 and pays $10 per year in rent to Columbus and no property tax to Delaware County on its 580 acres of land.[25] Delaware County does lose out on the potential of that land to yield property tax revenue from commercial or residential development, but it receives sales tax from the zoo and its affiliates.[26] Delaware County also reaps the economic bene t of the businesses and homes the zoo attracts to the area. Accordingly, Delaware County receives significant benefits from the zoo being located within it.

Why then are only Franklin County residents taxed? The Columbus Zoo’s officials have answered that they “have discussed expanding the zoo levy to nearby counties but don’t see that as viable.”[27] While it is somewhat ambiguous what is meant by “viable,” Franklin County residents should not have to pay more of the tax burden just because Delaware County residents do not want higher property taxes themselves, despite the economic benefits that they also directly receive.

The only “perk” Franklin County residents currently get from the zoo as a result of paying property taxes is half price admission on Wednesdays, and a preferred rate for Franklin County school groups.

Given the numerous benefits that Delaware County receives from the zoo, Franklin County taxpayers should consider whether it is fair that they be asked yet again to exclusively shoulder the increased tax burden alone.

Distribution of Funds: The Satellite Zoo

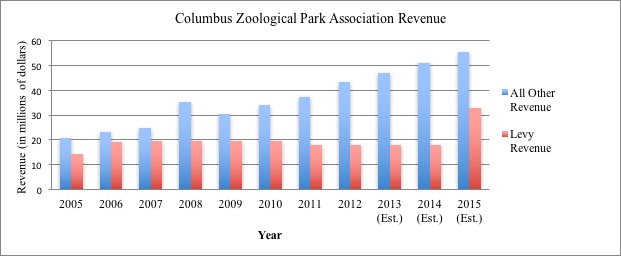

As the graph below shows, the zoo has experienced robust growth from 2005-2012, with non- levy revenues increasing 72 percent even as levy revenue was flat.[28] Based on the average annual growth from the past decade, non-levy revenue is expected to grow to $55.5 million by 2015. Passing this proposed levy would increase the amount of property tax revenue the zoo receives from approximately $18 million per year to about $32.5 million per year by 2015 according to the auditor’s estimates,[29] raising projected total revenue from $73.5 million to about $88 million.

A Dispatch report noted that the zoo planned to use $10 million of the $32.5 million annual levy revenue for operating costs and $12.75 million in capital expenditures at the existing zoo, with the other $9.75 million going to the downtown satellite branch.[30] Accordingly, the new levy would double what the Association takes from taxpayers to provide a $4.75 million bump in funds to the main zoo, while earmarking more than twice that amount for the satellite zoo.

This annual $9.75 million from taxpayers would be in addition to the $50 - 65 million the downtown branch is expected to cost to build. The downtown facility was not part of the zoo executives’ long-term plan, but was suggested by Columbus city officials as part of the larger Scioto peninsula renovation.[31]

The downtown satellite branch would undoubtedly be a substantial amenity for the City of Columbus, but taxpayers should consider whether the bene t of the downtown zoo is worth the substantial upfront and long-term price tag for the satellite branch, when the world-class main campus is only a few miles up the road.

Conclusion

The Columbus Zoo is a major attraction for Columbus, Franklin County, Delaware County, and the greater Central Ohio region. Accordingly, Franklin County voters have repeatedly shown their appreciation and support by approving requests for property tax levies.

Passing a more expensive permanent levy nearly eliminates taxpayers’ ability to hold the zoo accountable for operating in a fiscally responsible fashion with taxpayer funds. Franklin County voters should carefully consider whether the new levy imposes a free-rider problem of unfairness with only Franklin County residents contributing property tax revenue to the zoo from which Delaware County also reaps a myriad of economic benefits.

Other similarly structured zoos have been able to operate exceedingly well without relying so heavily upon property taxes for support. Franklin County taxpayers need to critically examine this proposal, especially in light of five years of consistent tax hikes that have chipped away at the area’s growth potential. Although Central Ohio has managed to avoid much of the persistent economic stagnation afflicting the rest of the state, pancaking tax-after-tax on top of each other will have severe negative effects on the region’s future.

Franklin County voters need to answer several questions for themselves before heading to the polls: Is a downtown satellite zoo worth the cost—both short term and long term? Is it fair that Delaware County residents do not share the property tax burden? Does an increase in millage seem necessary, considering both how well the zoo is doing on its own and how other top zoos have managed with less public support from property taxes? And finally, how much sense does it make to relinquish the power of voting on one’s own property taxes in the future?

1. Gallick, Thomas. ThisWeek Community News. “Proposed permanent tax would allow downtown expansion.” January 15, 2014 at http://www.thisweeknews.com/content/ stories/olentangy/news/2014/01/14/proposed-permanent-tax-would-allow-columbus-zoo-to- expand-downtown.html (Accessed March 18, 2014).

2. Ibid.

3. Provance, Jim. The Toledo Blade. “Ohio cancels property tax rollback.” July 29, 2013 at http://www.toledoblade.com/Politics/2013/07/29/Ohio-cancels-property-tax-rollback.html (accessed March 18, 2014).

4. Author’s calculation: difference of $153,600 house and 35% taxable value at 1.25 mills, and at 0.75 mills with a 12.5% rollback. House price data from: US Census Bureau. 2012 Selected Housing Characteristics. At http://factfinder2.census.gov/faces/tableservices/jsf/ pages/productview.xhtml?pid=ACS_12_5YR_DP04 (March 19, 2014).

5. Gray, Kathy Lynn. “Zoo’s levy request spurs comparisons.” The Columbus Dispatch. March 6, 2014 at http://www.dispatch.com/content/stories/local/2014/03/06/zoos-levy-request- spurs-comparisons.html (March 10, 2014).

6. Author’s calculation of Franklin County Auditor local tax rate records at http://www.franklincountyauditor.com/real-estate/tax-rates (March 17, 2014).

7. Author’s calculation of 2005 Franklin County Census $148,400 median home at 2004 median rate of 58.16 mills and 2012 Census $153,600 median home at median rate of 82.71 mills, both including rollbacks. Millage rates supra note 6. 2012 Census data supra note 4. 2005 house price data at http://fact nder2.census.gov/faces/tableservices/jsf/pages/ productview.xhtml?pid=ACS_05_EST_DP4&prodType=table (March 28, 2014).

8. Ohio Department of Taxation at http://www.tax.ohio.gov/portals/0/tax_analysis/tax_data_series/sales_and_use/salestaxmapcolor.pdf (March 29, 2014).

9. Government of District of Columbia, “Tax Rates and Tax Burdens in District of Columbia- A Nationwide Comparison,” at http://cfo.dc.gov/sites/default/files/dc/sites/ocfo/publication/attachments/2012%20Tax%20Rates%20and%20Tax%20Burdens_NATIONWIDE. pdf (Accessed March 27, 2014).

10. Romer, Christina D., and Romer, David H. “The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks.” American Economic Review, 100(3): 763-801.

11. Consolidated Financial Statements. Columbus Zoological Park Association. At https://www.colszoo.org/assets/zoo/user_files/file/Zoo%20consolidated%20Financial%20 nal%2012_29_12%20to%2012_29_11.pdf (February 19, 2014).

12. Columbus Zoological Park Association IRS Forms 990. At http://citizenaudit.org/314390844/ (March 14, 2014).

13. 2012 Annual Report at www.colszoo.org/assets/zoo/user_ les/ le/CZA_2012_ ANNUAL_REPORT%20Mar%202014.pdf (March 10, 2014).

14. Author’s analysis of Supra, note 12.

15. Supra, note 11; and Collective Bargaining Agreement between Columbus Zoo Association and the American Federation of State, Local County and Municipal Employees, AFL-CIO, Council 8, Local 2950. State Employment Relations Board at http://www.serb.ohio.gov/sections/research/WEB_CONTRACTS/11-MED-09-1155.pdf (April 24, 2014).

16. Ohio Secretary of State. “Ohio Ballot Questions and Issues Handbook” ch. 2 pp. 18-19. November 2013 at https://www.sos.state.oh.us/SOS/Upload/elections/EOresources/ general/2013QandI.pdf (March 12, 2014).

17. Grant, Michael. “Phoenix Bond 101.” Eight, Arizona PBS. February 14, 2006 at http:// www.azpbs.org/arizonahorizon/detail.php?id=270 (March 20, 2014).

18. Kelly, Michael. “K.C. Zoo’s new exhibit gets penguin donation from Omaha’s Henry Doorly Zoo.” Omaha World-Herald. November 2, 2013 at http://www.omaha.com/apps/pbcs. dll/article?AID=/20131102/NEWS/131109696/1699 (March 18, 2014).

19. San Diego Auditor. “Performance Audit of the Zoological Exhibits Fund.” May 2013 at www.sandiego.gov/auditor/reports/fy13_pdf/audit/13-013_Zoo_Fund.pdf (March 20, 2013).

20. Author’s analysis of 2012 IRS Form 990 at www.sandiegozoo.org/pressbox/annualreport/ZSSD_2012_990_Public_Inspection.pdf (March 11, 2014).

21. 2012 Financial Statements. Metropolitan Zoological Park and Museum District at www.mzdstl.org/ZMDFinancials/2013/2013%20ZMD%20Dec%2031,%202012%20&%202011%20Financial%20Statements%20&%20Independent%20Auditors%27%20Report.pdf (February 20, 2014).

22. Supra, note 1.

23. Supra, note 16.

24. Ibid. (citing State ex rel. Choices for South-Western City Sch. v. Anthony, 108 Ohio St. 3d, 2005-Ohio-5362).

25. Supra, note 11.

26. Fisher, Ann. “Pony Up: The Columbus Zoo Levy.” Interview February 12, 2014. Accessed at http://wosu.org/2012/allsides/pony-up-the-columbus-zoo-levy/ (March 12, 2014).

27. Supra, note 5.

28. Supra, note 12.

29. Supra, note 5.

30. Gray, Kathy Lynn. “Zoo wants vote on bigger, permanent property tax.” The Columbus Dispatch. January 9, 2014 at http://www.dispatch.com/content/stories/local/2014/01/09/zoo-wants-vote-on-bigger-permanent-property-tax.html (March 9, 2014).

31. Ibid.