Stop being obsessed with “income inequality” and get obsessed with creating jobs

Feb 20, 2014

Recently, there has been a lot of talk about the issue of income inequality. In a Gallup poll released on February 17, 23% of Americans listed “Unemployment/Jobs” as the number one problem facing the country. Despite insistence by the Obama administration that an increasing gap between the richest and poorest Americans is the issue that deserves top priority, Americans do not agree.

The reason for this disconnect is in part a reflection of disparities in methodologies commonly used in income inequality studies. As the Cato Institute has found, methodologies based on IRS tax returns do not take into account the changes in U.S. tax rules since the 1970s that have encouraged individuals to report greater income for the purpose of tax collecting. As The Heritage Foundation points out, another common methodology uses Census data, which counts households rather than individuals, underestimates existing wealth transfer policy, and does not use equal quintiles.

As the Hoover Institute argues, a better measure of inequality would focus more on consumption. This methodology would better take into account the impact of taxes and existing wealth transfer policies.

For a picture of the impact of income redistribution through the use of the Federal tax code, consider these recent findings from the Tax Foundation,

- American’s lowest-income families receive $5.28 worth of government spending (federal, state, and local) for every $1 they pay in total taxes. Middle-income families receive $1.48 in total spending per tax dollar, while America’s highest-income families receive $0.25 cents in spending for every dollar of taxes paid.

- As a group, the bottom 60 percent of American families receive more back in total government spending than they pay in total taxes.

- Government tax and spending policies combine to redistribute more than $2 trillion from the top 40 percent of families to the bottom 60 percent.

- The total amount of redistribution has increased slightly over the past 12 years. Middle-income and working lower-income families were the biggest beneficiaries.

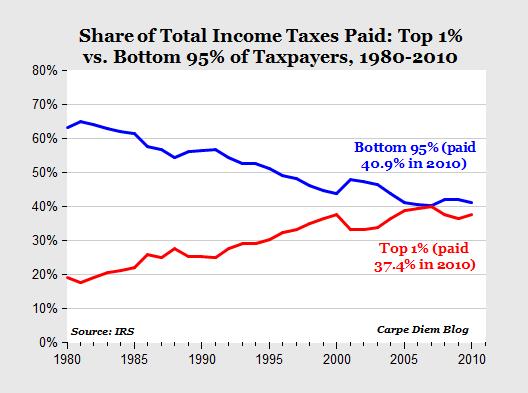

It is notable that the fabled “1 Percent” currently pays collectively almost as much in income tax as the bottom 95 percent combined. You can read more on that here and be sure to note the below chart.

Ultimately, the talk of income inequality obscures something that Ohioans and Americans know too well: since the Great Recession, not enough jobs are being created. The labor force participation rate is at historic lows. As the CBO recently identified, new disincentives for work associated with Obamacare are set to pressure labor participation even further downward. Instead of offering additional disincentives for work and using redistributionist tax policies to divvy up a stagnantly growing economic pie, we need to find ways to increase opportunity, promote business growth, and encourage people to work so that all workers, across all income levels, can share in the fruits of a larger economic pie.