|

|

Piglet Book |

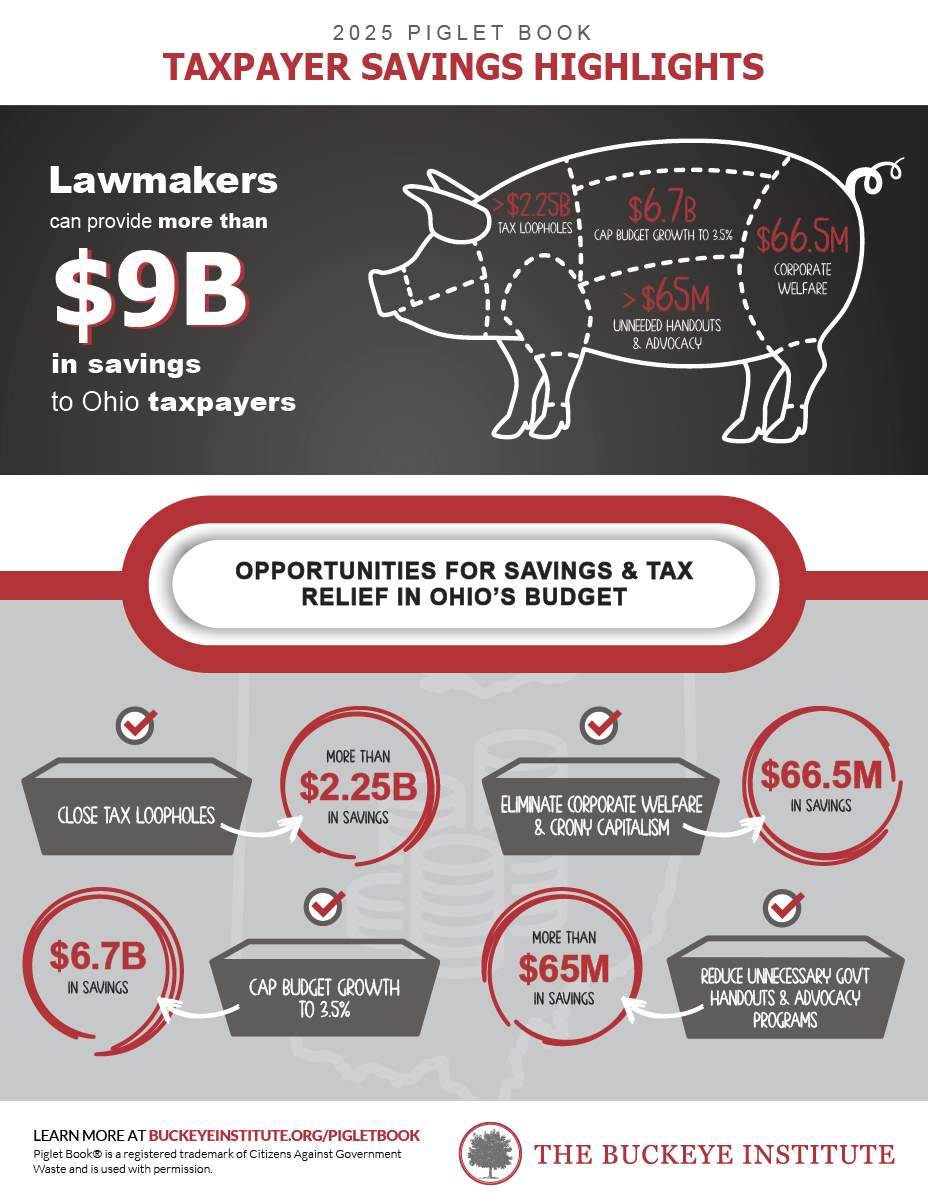

Every two years, lawmakers must adopt a new biennial budget, accounting for most of Ohio’s spending. To help guide policymakers as they debate the budget, The Buckeye Institute analyzes the governor’s initial proposal to identify areas where legislators can provide savings to taxpayers, implement pro-growth tax cuts, eliminate wasteful spending, close tax loopholes, and end corporate welfare.

The 2025 edition of the Piglet Book recommends keeping Ohio economically competitive by aggressively prioritizing cuts to public spending, curbing Medicaid growth rates, closing tax loopholes, eliminating corporate welfare, and ending government “philanthropy.”

If followed, the recommendations in the 2025 Piglet Book would provide more than $9 billion in savings for Ohio taxpayers by:

- Resetting the baseline by capping the increases in Ohio’s all funds budget, including Medicaid, to 3.5 percent, saving Ohioans $6.7 billion.

- Closing tax loopholes saving Ohioans more than $2.25 billion.

- Ending corporate welfare saving Ohioans $66.5 million.

- Ending government philanthropy and advocacy, saving Ohioans more than $65 million.

While the Piglet Book focuses on Ohio’s biennial budget, there are other areas where policymakers can find savings for taxpayers, including reining in Ohio’s capital budget and overhauling Ohio’s Medicaid program, K-12 public education, and criminal justice system.

Piglet Book® is a registered trademark of Citizens Against Government Waste and is used with permission.

.

.