Policy Research & Reports

Structure Over Spectacle: The Supreme Court's 2024 Term

December 23, 2025

“After several years of headline-grabbing decisions that reshaped national political debate—from abortion and affirmative action to religious liberty and presidential power—in its October 2024 Term, the United States Supreme Court largely stepped back from the culture war flashpoints and focused on institutional structure, procedural discipline, and interpretive clarity.” In Structure Over Spectacle, The Buckeye Institute’s David C. Tryon and the Defense of Freedom Institute for Policy Studies’ Donald A. Daugherty look back on the U.S. Supreme Court’s 2024 term.

The Buckeye Institute Releases Economic Freedom of North America 2025 Report

December 15, 2025

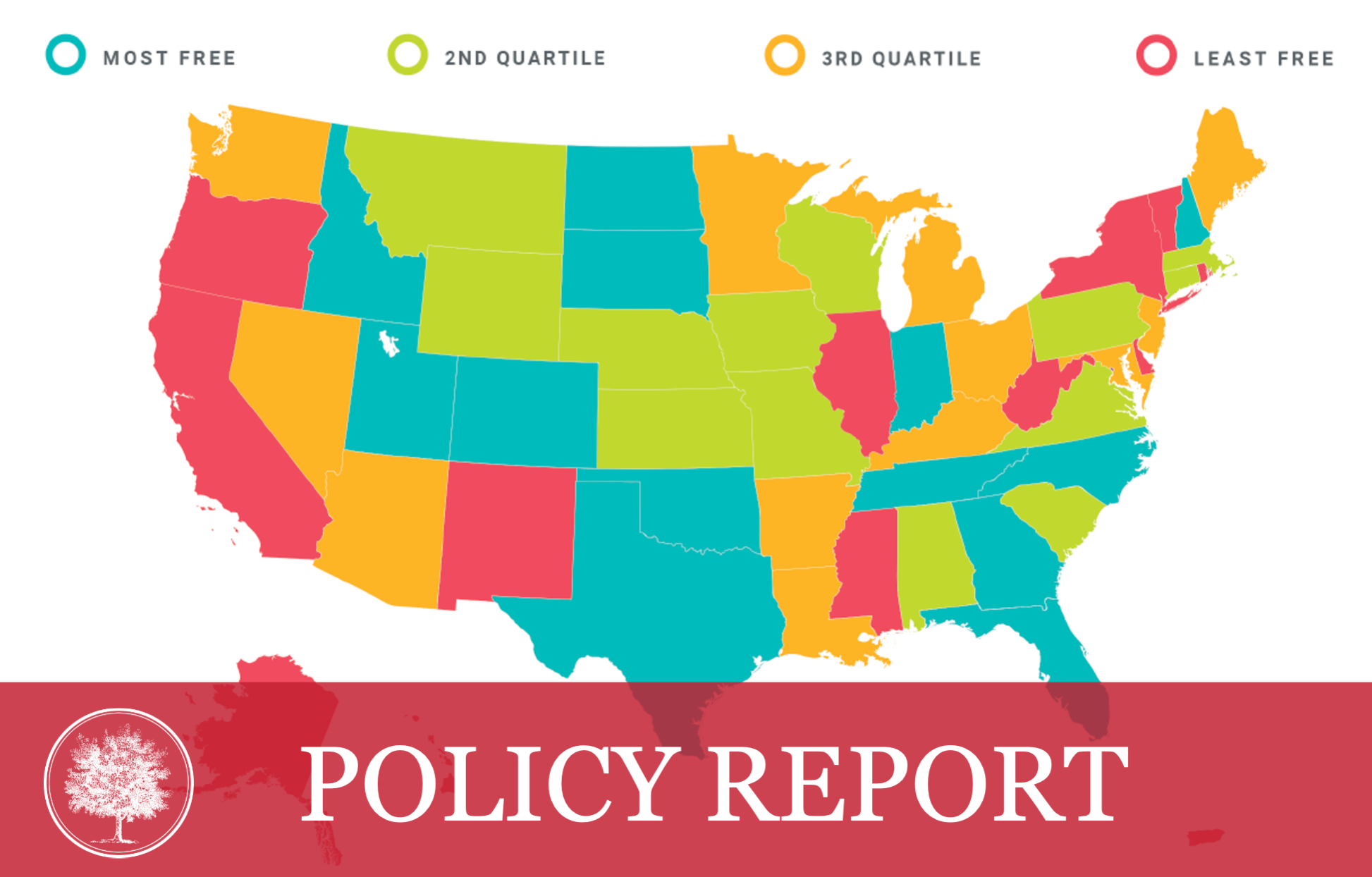

In 2025, Ohio maintained its 35th place ranking in the Economic Freedom of North America 2025 (EFNA) report for the second year in a row. The report, released by The Buckeye Institute in partnership with Canada’s Fraser Institute, ranks all states and provinces in the United States, Canada, and Mexico, as well as the U.S. territory of Puerto Rico, based on economic freedom, measured by government spending, taxation, and labor-market freedom.

The Buckeye Institute: Federal Reform Efforts Best Path to Fix Broken 340B Program

December 03, 2025

As Ohio lawmakers look for solutions to fix a broken 340B drug pricing program, The Buckeye Institute released a new policy brief—The 340B Fix: Federal Bipartisan Effort Best Path to Reform—outlining how the program came to neglect its well-intended goals and urged Ohio policymakers to encourage federal reforms percolating in Washington. “The 340B program requires federal reforms to fix the broken program, and Ohio leaders should encourage that effort.”

The Buckeye Institute: SB 256 & HB 534 Will Help Ohioans Get Out of Debt

November 06, 2025

In a new policy memo, The Buckeye Institute outlines how Senate Bill 256 and House Bill 534 take reasonable, necessary steps to help Ohio families seeking debt relief. “Ohio’s household debt crisis demands practical, consumer-focused solutions. Clarifying the state’s debt-settlement law offers a responsible path forward by enhancing consumer choice. Senate Bill 256 and House Bill 534 take reasonable, necessary steps to help Ohio families seeking debt relief.”

The Buckeye Institute Identifies 39 Occupational Licenses Ohio Can Eliminate or Reform

October 06, 2025

As the Ohio House General Government Committee begins its review of Ohio occupational licenses, The Buckeye Institute issued its fourth Opening Doors policy brief, where it identified 39 licenses that the state should eliminate or reform to make Ohio more economically competitive and make it easier for people to earn a living. Since 2019, Ohio has eliminated or reduced requirements for nearly 100 licenses based on The Buckeye Institute’s recommendations.

Keep, Cut, Change: The Buckeye Institute Offers Roadmap to Ohio’s Budget Conference Committee

June 17, 2025

As the Budget Conference Committee begins its work on Ohio’s biennial budget and analyzes some hotly-contested issues, The Buckeye Institute released Keep, Cut, Change, its recommendations for which version of the budget—governor’s, House, or Senate—lawmakers should adopt and what should be cut or changed. “By adopting The Buckeye Institute’s recommendations, policymakers will achieve effective policy outcomes that benefit all Ohioans.”

The Buckeye Institute: AI Reg Sandbox Can Lower Costs, Cut Red Tape, Advance Healthcare Technology

April 10, 2025

In a new policy brief, Advancing Healthcare Technology, The Buckeye Institute urges lawmakers to create a “regulatory sandbox” so that AI innovators can develop new medical technologies in a flexible, safe regulatory environment that lowers costs and cuts red tape. An AI healthcare sandbox “will allow healthcare providers, AI developers, and policymakers to collaborate and responsibly test novel technologies related to drug development, medical imaging, disease diagnosis, gene therapy, medical research, and health data management...”

The Buckeye Institute’s World-Famous Piglet Book Identifies More Than $9 Billion in Savings for Ohio Taxpayers

March 20, 2025

The Buckeye Institute released its world-famous 2025 Piglet Book, which identified more than $9 billion in savings for Ohio taxpayers. The Piglet Book analyzes Ohio’s proposed biennial budget to offer specific savings for lawmakers to consider as they debate the state’s two-year budget. “To help keep Ohio economically competitive, the General Assembly should aggressively prioritize cuts to public spending, curb Medicaid growth rates, close tax loopholes, eliminate corporate welfare, and end government ‘philanthropy.’”

The Buckeye Institute Offers Commonsense Reforms to Lower Property Taxes

March 06, 2025

With property taxes in many parts of Ohio skyrocketing, The Buckeye Institute released a new policy memo recommending commonsense reforms state and local officials should adopt to help lower property taxes, the rise of which stems from Ohio’s complex local tax and government structures. In the memo, Buckeye notes that “[w]ith more than 3,900 local government bodies and taxing authorities…Ohio adds unnecessary layers of fragmented, redundant bureaucracy that duplicate administrative functions and impose higher operational costs.” These redundancies require Ohioans to pay ever higher property taxes.

The Buckeye Institute: Failure to Index Tax Brackets to Inflation Cost Ohioans $663 Million

February 24, 2025

As Ohio’s 136th General Assembly continues its work on the state’s 2026-2027 budget, The Buckeye Institute issued a new policy memo demonstrating that not indexing Ohio’s income tax brackets to inflation in “2023-2024 cost Ohio taxpayers $663 million.” The memo urged lawmakers to “resist the temptation to suspend indexing going forward” and “make inflation-indexing a permanent part of [Ohio’s] income tax policy.”