The Buckeye Institute Offers 10 Specific Recommendations to Lower Property Taxes

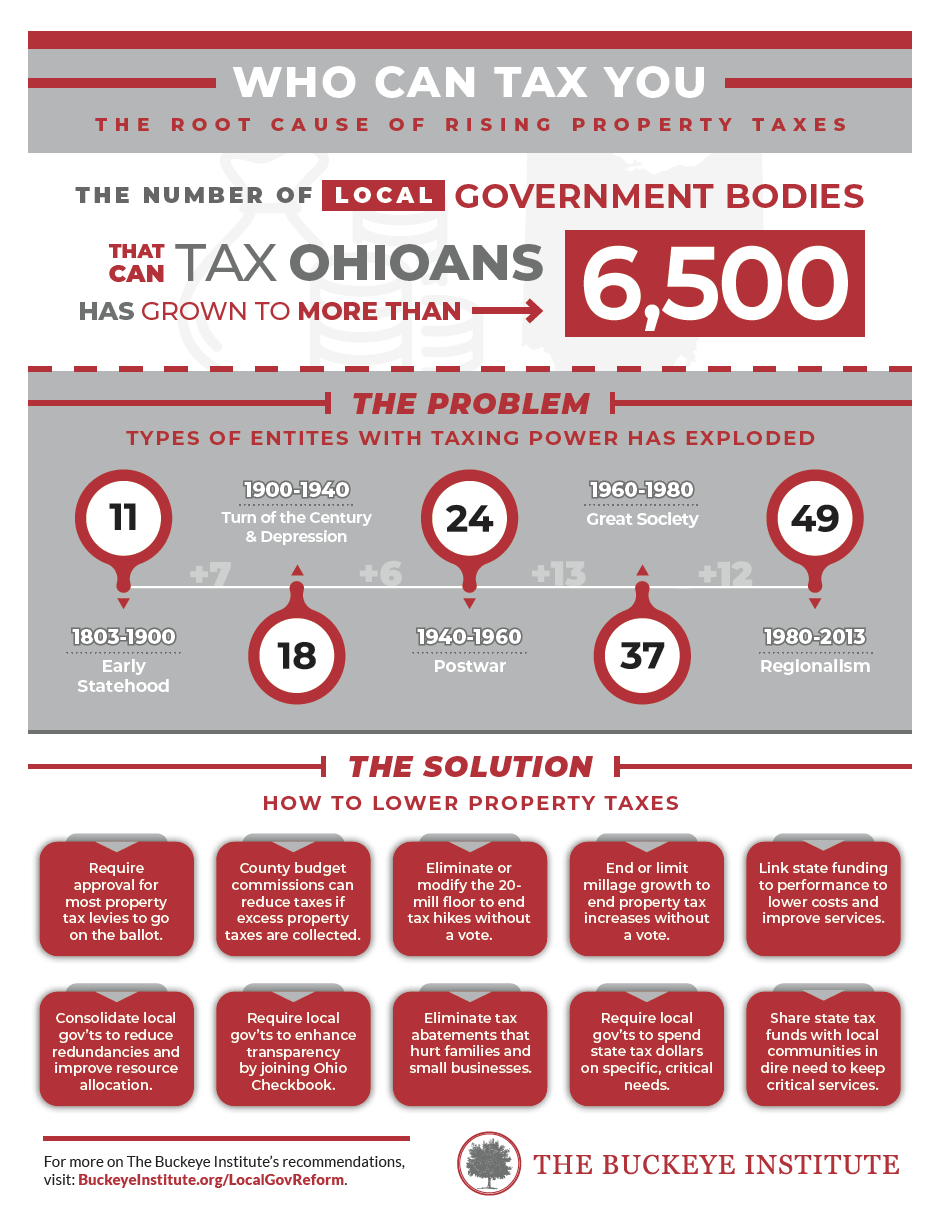

Jul 23, 2025Columbus, OH – As Governor Mike DeWine’s Property Tax Reform Working Group begins its work, The Buckeye Institute outlined 10 specific recommendations to reform local government and reduce the soaring property tax burden afflicting Ohio homeowners.

“Ohioans fearful of losing their homes are demanding reform and threatening a constitutional amendment to abolish property taxes altogether,” said Greg R. Lawson, a research fellow at The Buckeye Institute who has written extensively on local government reform. “Tough choices are needed to avoid this draconian step, and The Buckeye Institute’s work offers the Property Tax Reform Working Group a roadmap to real reform that will lower property taxes while maintaining critical local government services.”

A leader in local government reform, The Buckeye Institute offers the Property Tax Reform Working Group 10 commonsense policy solutions to reform local government and lower property taxes:

- Require county commissioners or county budget commissions to approve most property tax levies before they are placed on the ballot.

- Give county budget commissions the authority to lower the tax rate when more property taxes than are necessary are collected from homeowners.

- Eliminate or modify the 20-mill floor to prohibit school districts from increasing property taxes on Ohioans without a vote.

- Eliminate or cap the growth of inside millage to prohibit property tax increases not explicitly approved by voters.

- Incentivize and link state funding to specific performance metrics and efficiency improvements to reduce local government expenses while maintaining or enhancing service quality.

- Consolidate the number of local government entities to minimize administrative redundancies, streamline decision-making processes, and ensure better resource allocation.

- Require all local governments to make their operations more transparent by joining the Ohio Checkbook.

- Eliminate tax abatements that shift property tax burdens onto families and small businesses.

- Require local governments to spend state tax dollars on specific, critical needs.

- Share state tax dollars with local communities needing support to provide critical goods and services.

Find these and other recommendations at BuckeyeInstitute.org/LocalGovReform and in:

- Local Government Reform Necessary to Lower Property Taxes (2025)

- Sustainable Ohio: How to Fund Ohio’s Cities in the 21st Century (2022)

- Local Government Funding Reform: Cost-Saving Alternatives to State Revenue Sharing (2019)

- Joining Forces (2011)

# # #