The Buckeye Institute Outlines Path to a Flat Tax

May 24, 2023Columbus, OH – In a new policy memo, How Ohio Can Join the Flat-Tax Revolution (see full text below or download a PDF), The Buckeye Institute outlines how Ohio can “lower tax rates for everyone” and use revenue triggers “along the way to an across-the-board flat-tax.”

In their policy memo, Logan Kolas, an economic policy analyst with Buckeye’s Economic Research Center (ERC), and Zachary D. Cady, an associate economist with the ERC, note that moving Ohio to a 2.75 percent flat tax would “result in a $2.5 billion boost to GDP, thousands of new jobs, and $800 million in increased investment in 2024.”

To get there, Kolas and Cady suggest policymakers “set the second-to-lowest rate at 2.75 percent, leave the bottom bracket untaxed, and then proportionally lower all other rates to get there over time.” In their modeling, Kolas and Cady demonstrate that this approach would “limit the rate cut’s budget impact and keep Ohio on course to flatten the income tax.”

Kolas and Cady close by urging the Ohio Senate to eliminate Ohio’s harmful progressive income tax and “join the flat-tax revolution sweeping the country.”

# # #

How Ohio Can Join the Flat-Tax Revolution

Logan Kolas & Zachary D. Cady

May 24, 2023

The Buckeye Institute’s Recommendation

Since 1971, Ohio taxpayers have been plagued by a progressive income tax. Now more than ever, that tax makes the state less competitive and its people less prosperous, and the time for reform is now. Some have proposed reducing the income tax rate for some taxpayers but not others. Instead, Ohio should lower tax rates for everyone and create precautionary revenue triggers along the way to an across-the-board flat tax.

Background

Ohio policymakers have debated income tax reform for decades. A six-bracket tax structure with a 3.5 percent max rate in the 1970s swelled to nine brackets with a 7.5 percent top rate by the 1990s, and more families kept less of their money. Lawmakers have since worked to repair the damage. There are now only five tax brackets, the top rate is just shy of four percent, and those making less than $25,000 per year pay no personal income tax at all. All strides in the right direction, but still underperforming neighboring states that have embraced a true flat tax.

Only corporate income taxes are more harmful economically than personal income taxes. And, as the Congressional Budget Office has explained, progressive income taxes that treat taxpayers differently are more harmful than flat-rate taxes that treat them the same. Estimates by The Buckeye Institute show that moving Ohio to a flat 2.75 percent personal income tax rate would result in a $2.5 billion boost to GDP, thousands of new jobs, and $800 million in increased investment in 2024.

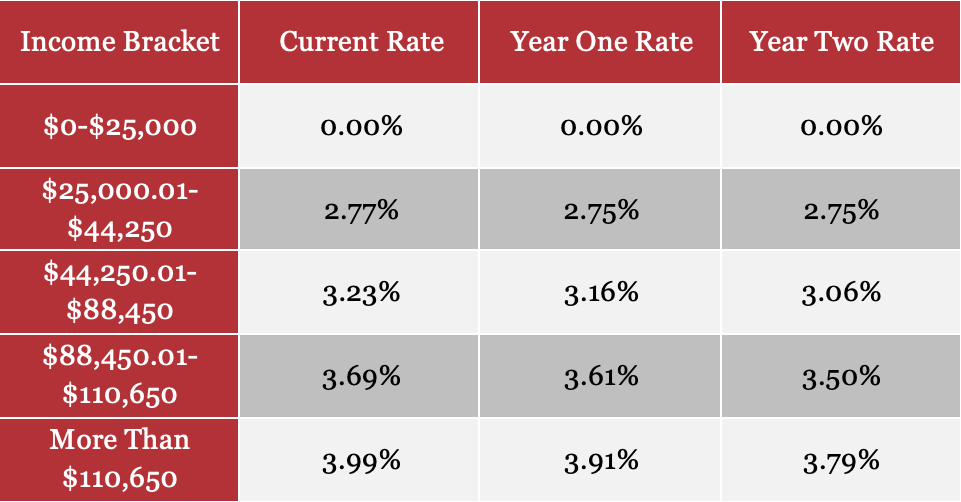

To hit that target responsibly, policymakers can set the second-to-lowest rate at 2.75 percent, leave the bottom bracket untaxed, and then proportionally lower all other rates to get there over time. This would limit the rate cut’s budget impact and keep Ohio on course to flatten the income tax. The Buckeye Institute’s Economic Research Center (ERC) statically modeled the first two years of this phased-in approach towards a 2.75 percent flat tax. (See Table I.) The ERC assumed a static revenue decrease of $400 million in year one and then projected the impact on the top three tax brackets to pay for the decrease in tax revenue if (1) the bottom bracket continued to pay nothing; (2) the $25,000.01-$44,250 bracket paid 2.75 percent; and (3) all other bracket rates dropped proportionally. The ERC took the same approach for year two, but assumed a $500 million revenue decrease relative to year one. This gradual approach would move Ohio toward a 2.75 percent flat tax while responsibly phasing in the real revenue decreases rather than having them all hit at once.

Table I. Graduated Transition to a 2.75% Flat Tax

A flat-tax would spur economic growth and make Ohio more competitive, but it would also make future tax hikes more difficult. As Jared Walczak of the Tax Foundation explains, flat taxes show a willingness go “all-in” on tax reform, while making the tax code less prone to targeted, inefficient tax increases. Too often, proposals to tax only the wealthy have found ways ultimately to raise taxes for everyone. Flat taxes make this bait-and-switch more difficult politically.

Ohio can and should flatten its income tax, but it should not take unnecessary economic risk while doing so. Revenue triggers—lowering tax rates as revenue meets pre-established targets—should be included along the way. State law should require that as Ohio meets expected revenue targets, taxpayer rates will automatically be cut. Such triggers will help smooth revenue changes in the face of changing economic conditions and ensure excess revenue is returned to taxpayers instead of spent by the government.

Conclusion

Ohio’s progressive personal income tax makes it harder to compete economically with other states. Workers and employers have seen the advantages offered by flat-tax states and are choosing them over Ohio. An across-the-board tax rate reduction is a step in the right direction and should be pursued, but now is the time for bolder tax reform. Ohio should eliminate its harmful progressive taxation and join the flat-tax revolution sweeping the country.

# # #