Tax Cuts and Jobs Act Offers Ohioans Real Back-to-School Savings

Jul 30, 2018With the start of school comes the onslaught of sales and articles touting back-to-school savings and the popular sales tax holiday. “Back to School Tax Holiday Approaching” and “Ohio Sales Tax Holiday to Provide Families Relief During Back-to-School Shopping,” read the headlines—making it clear that taxes are a real burden on Ohio families.

While we don’t support temporary tax holidays that only offer Ohioans temporary tax relief, we are fans of permanent tax cuts that save taxpayers money and help grow our economy. And that is what Ohioans saw when Congress passed the Tax Cuts and Jobs Act.

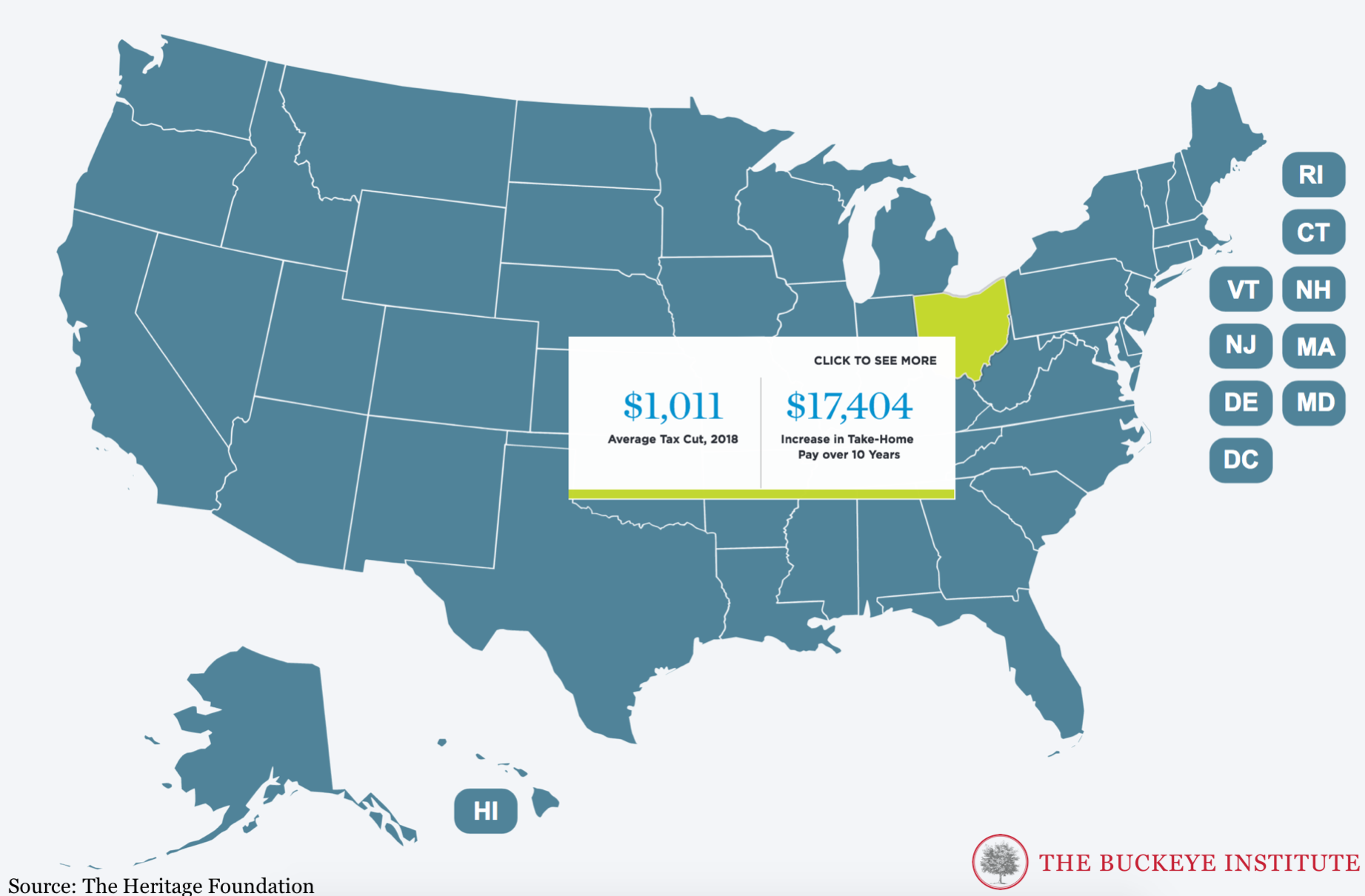

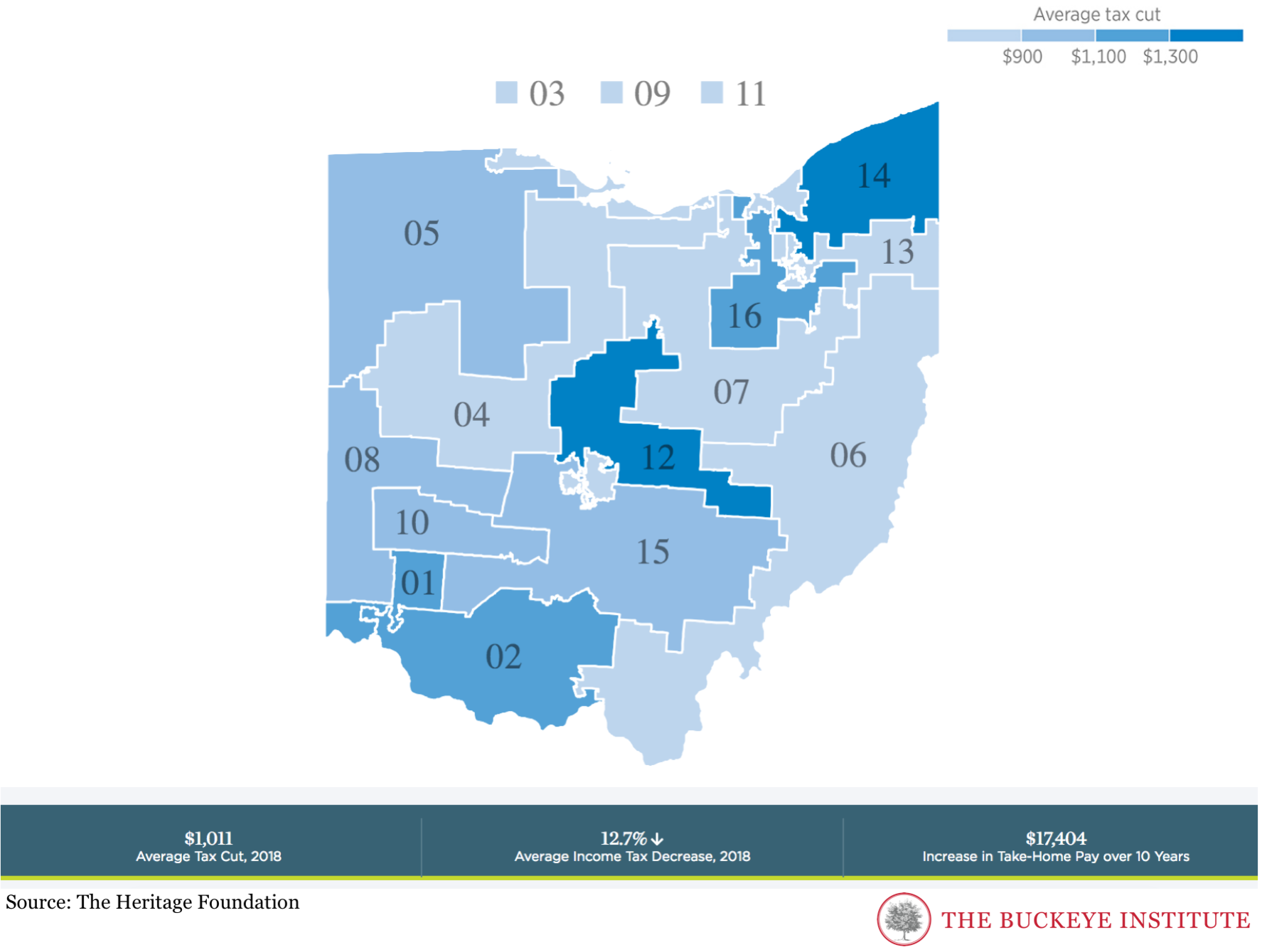

Finally, the federal government is letting us keep more of our hard-earned money rather than taking it. According to the Heritage Foundation’s Protect Our Paychecks tool, on average, Ohio taxpayers will see a $1,011 tax cut in 2018. That’s a $17,404 increase in take-home pay over the next 10 years! Now that’s some real back-to-school savings.

Keeping more money isn’t the only benefit of the tax cut. According to Heritage, 45,600 jobs have been created in Ohio since the tax cut was passed, and companies have raised wages and increased investment throughout the state.

But tax reform shouldn’t end in Washington, DC. Ohio policymakers have work to do reforming our state and local taxes to ensure we have a pro-growth system and to ensure your hard-earned money is spent wisely and effectively.

We have made the job a bit easier for policymakers by outlining Tax Reform Principles for Ohio, which can be used as a benchmark to create a system that is pro-growth, simple, and equitable. And we have outlined a number of specific reforms that policymakers should undertake—such as improving the municipal income tax structure, getting rid of special interest exemptions such as the NetJets loophole and the motion picture tax credit, and nixing the commercial activities tax or gross receipts tax.

These, and other tax policy changes, would streamline and simplify our tax system making it easier for businesses to grow and letting you keep more of your money. And that’s the real back-to-school savings Ohioans need to see.

Quinn Beeson was the economic research analyst at The Buckeye Institute’s Economic Research Center.