At Invitation of Property Tax Reform Working Group, The Buckeye Institute Submits Testimony

Sep 18, 2025Columbus, OH – On Thursday, The Buckeye Institute submitted written testimony (see full text below or download a PDF) at the invitation of Ohio’s Property Tax Reform Working Group. Buckeye’s testimony outlines 10 specific recommendations to reform local government and reduce the soaring property tax burden afflicting Ohio homeowners.

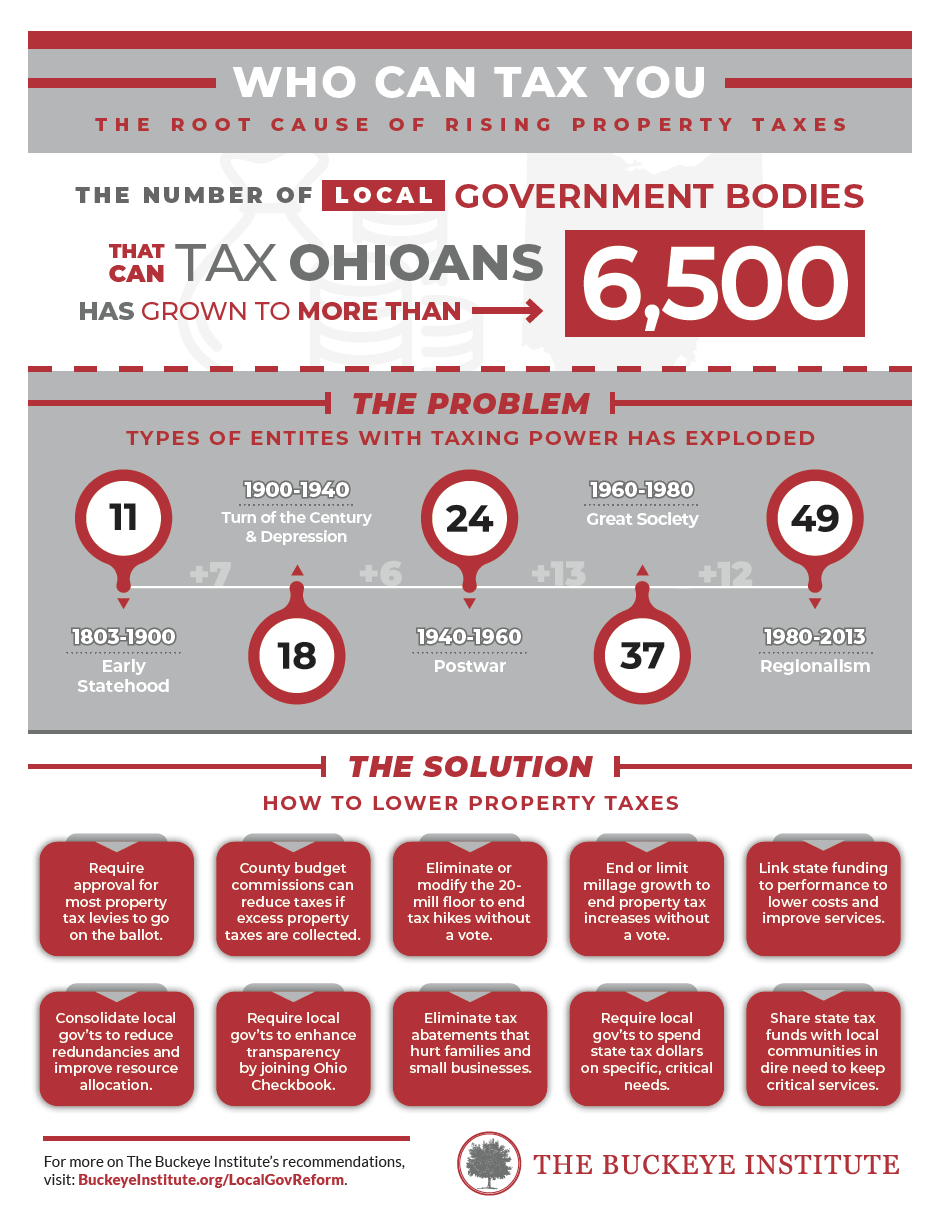

In his testimony, Greg R. Lawson, a research fellow at The Buckeye Institute, noted that the driving force behind increasing property taxes is the “ever-rising cost of maintaining Ohio’s extraordinarily complicated local government structure.” With 49 different types of taxing authorities and more than 6,500 local government authorities that can levy taxes, Ohio has the 8th highest local tax burden as a percentage of income in the nation.

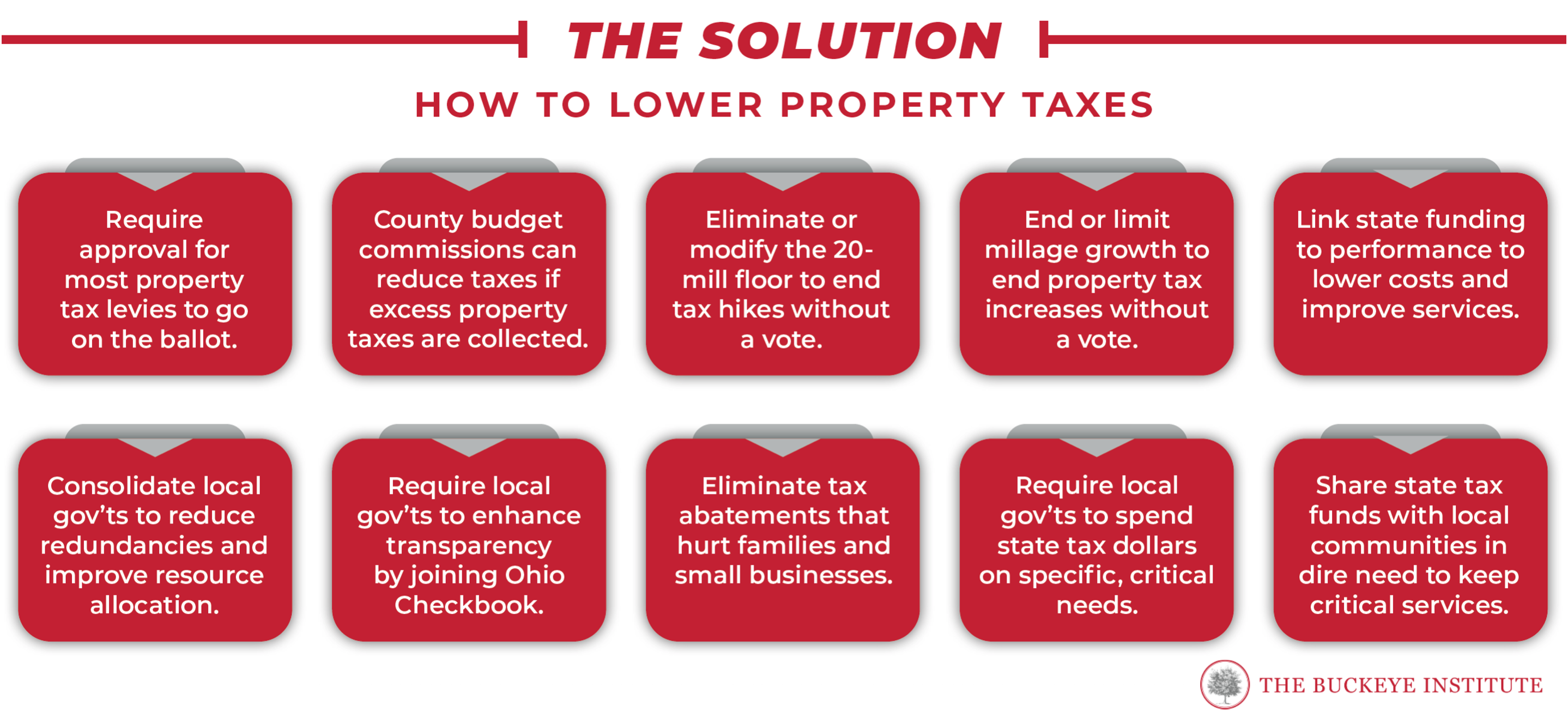

Lawson went on to offer 10 policy solutions to the Property Tax Reform Working Group to reform local government and lower property taxes:

- Require county commissioners or county budget commissions to approve most property tax levies before they are placed on the ballot.

- Give county budget commissions the authority to lower the tax rate when more property taxes than are necessary are collected from homeowners.

- Eliminate or modify the 20-mill floor to prohibit school districts from increasing property taxes on Ohioans without a vote.

- Eliminate or cap the growth of inside millage to prohibit property tax increases not explicitly approved by voters.

- Incentivize and link state funding to specific performance metrics and efficiency improvements to reduce local government expenses while maintaining or enhancing service quality.

- Consolidate the number of local government entities to minimize administrative redundancies, streamline decision-making processes, and ensure better resource allocation.

- Require all local governments to make their operations more transparent by joining the Ohio Checkbook.

- Eliminate tax abatements that shift property tax burdens onto families and small businesses.

- Require local governments to spend state tax dollars on specific, critical needs.

- Share state tax dollars with local communities needing support to provide critical goods and services.

Find these and other recommendations at BuckeyeInstitute.org/LocalGovReform.

# # #

Property Taxes: Untying Ohio’s Gordian Knot

Testimony to the Property Tax Reform Working Group

Greg R. Lawson, Research Fellow

The Buckeye Institute

September 18, 2025

As Submitted

Chairs Tiberi and Seitz, and members of the Working Group, thank you for the opportunity to submit written testimony regarding the financial burden imposed by Ohio’s property taxes and the reforms needed to address it.

My name is Greg R. Lawson. I am a research fellow at The Buckeye Institute, an independent research and educational institution—a think tank—whose mission is to advance free-market public policy in the states.

Ohio’s property tax system has become like the mythical Gordian Knot that was so intricately woven that no one could untie it for centuries. Tired of trying, legend holds that Alexander the Great drew his sword and cut the knot. His reward was eternal glory.

Similar knot-cutting efforts are currently underway here in Ohio with activists petitioning and some elected officials supporting a constitutional ballot initiative to eliminate property taxes entirely. If successful, that misguided effort would gut local public services with no reasonable revenue replacement—but the sentiment is understandable and the public’s outrage over skyrocketing property taxes should not be ignored.

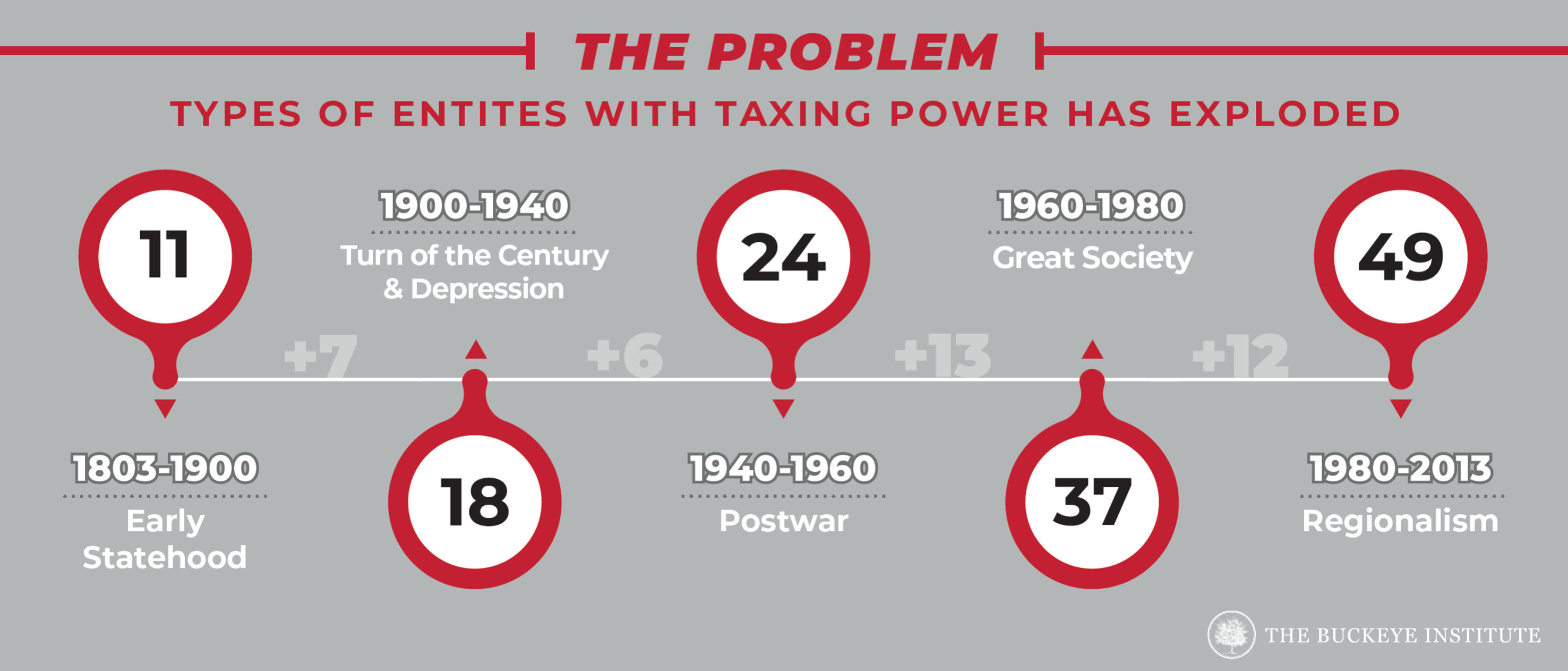

A perennial and paramount problem has been the ever-rising cost of maintaining Ohio’s extraordinarily complicated local government structure. Forty-nine different types of taxing authorities and more than 6,500 local government authorities can levy taxes in Ohio, including the generally known municipalities, townships, school, and libraries, and the lesser-known local councils, workforce investment boards, and community land reutilization corporations. According to the Ohio Department of Taxation, these sundry authorities imposed the 8th highest local tax burden as a percentage of income in the nation in fiscal year 2022—a worse finish than Ohio’s 12th place ranking in fiscal year 2021. And there is no reason to believe the situation has improved.

But rather than abolishing local property taxes as some have proposed, The Buckeye Institute suggests 10 policy solutions to consider instead.

For short-term taxpayer relief, the General Assembly should clarify statutory ambiguities and authorize local budget commissions to prospectively reduce their property tax rates when localities are projected to collect more than necessary to meet funding requirements. Many school districts, for example, maintain large carry-over balances at the end of the school year, sometimes more than a year’s worth of spending. And they are not alone. Other local governments keep large cash hoards while taxing residents at higher-than-needed rates. Voters may not always be aware of these local surpluses, so county boards and budget commissions should be explicitly authorized to align property tax rates with local fiscal realities. The governor vetoed this authorization in the recent budget and the General Assembly should override it.

For medium-term relief, the General Assembly should eliminate or amend the 20-mill floor for public schools, and cap the inside millage growth rate at inflation’s pace. These measures would likely put more school levies on the ballot, but at least they would give local voters a voice rather than raise taxes without their consent. Removing the 20-mill floor limit for schools would return control over property taxes to homeowners in more than half of Ohio’s 600-plus school districts.

In the longer run, Ohio must finally address its over-complicated, byzantine patchwork of more than 6,500 local governments and special districts with varying taxing authorities. In Cuyahoga County alone there are 105 different taxing authorities, and Ohio has more than 600 school districts—each the single largest driver of local property taxes. Florida, by contrast, has fewer than 100 school districts despite having a much larger population and a faster-growing economy. Without transformational change to Ohio’s antiquated local government structure, homeowners will continue to suffer rising, unsustainable property taxes even if the state adopts short- and medium-term reforms. Accordingly, Ohio policymakers should incentivize efficiencies to reduce local government expenses, encourage localities to share more public services, and then consolidate local jurisdictions to minimize administrative redundancies and improve resource allocation.

Finally, local levies in Ohio should be streamlined and simplified, and every local government should join the Ohio Checkbook so that their spending and operations are transparent and accountable to voters. Without fiscal transparency, local taxpayers cannot know how their tax dollars are spent. Instead, they confront an ever-tighter tangle of bureaucracy, political finger-pointing, and automated property tax hikes. Local communities cannot afford the public services to which they are accustomed without property taxes, so their abolition would be a mistake. But neither can homeowners afford the rising price of Ohio’s multi-layered mass of local government. This working group and the General Assembly must pursue bold reforms to relieve taxpayer burdens quickly and responsibly untie the Gordian Knot that binds them.

Thank you for the opportunity to submit written testimony.

# # #