New Buckeye Institute Economic Modeling Reveals Billions in Economic Growth Possible for Georgia

Mar 07, 2024Columbus, OH – A new report, Next Steps for Georgia Tax Reform, by The Buckeye Institute, found that cutting taxes would lead to billions in economic growth and business investment in the Peach State. The Buckeye Institute partnered with Georgia Public Policy Foundation to conduct the research.

“Georgia has undertaken several positive tax reforms that have spurred economic growth, but the state must continue to reform its tax policies if it wants to remain competitive,” said report co-author Rea S. Hederman Jr., executive director of the Economic Research Center and vice president of policy at The Buckeye Institute. “The Buckeye Institute’s modeling shows that by incrementally cutting tax rates, Georgia will attract and keep more workers and businesses.”

INFOGRAPHIC: Next Steps for Georgia Tax Reform

“Georgia has enjoyed strong growth in recent decades, but our neighboring states have been busy boosting their own competitiveness—including through tax reform. The best way to keep Georgia working is to keep our own edge, and I’m grateful to our friends at The Buckeye Institute for highlighting a variety of ways to do that,” said Kyle Wingfield, president and CEO of Georgia Public Policy Foundation.

READ MORE: Next Steps for Georgia Tax Reform by Rea S. Hederman Jr.

Using a dynamic scoring model—STELA (state tax and economic long-run analysis)—developed by economists at The Buckeye Institute, the report’s authors analyzed four scenarios to give Georgia policymakers a better understanding of how each proposal will affect the state’s businesses, families, economy, and revenues.

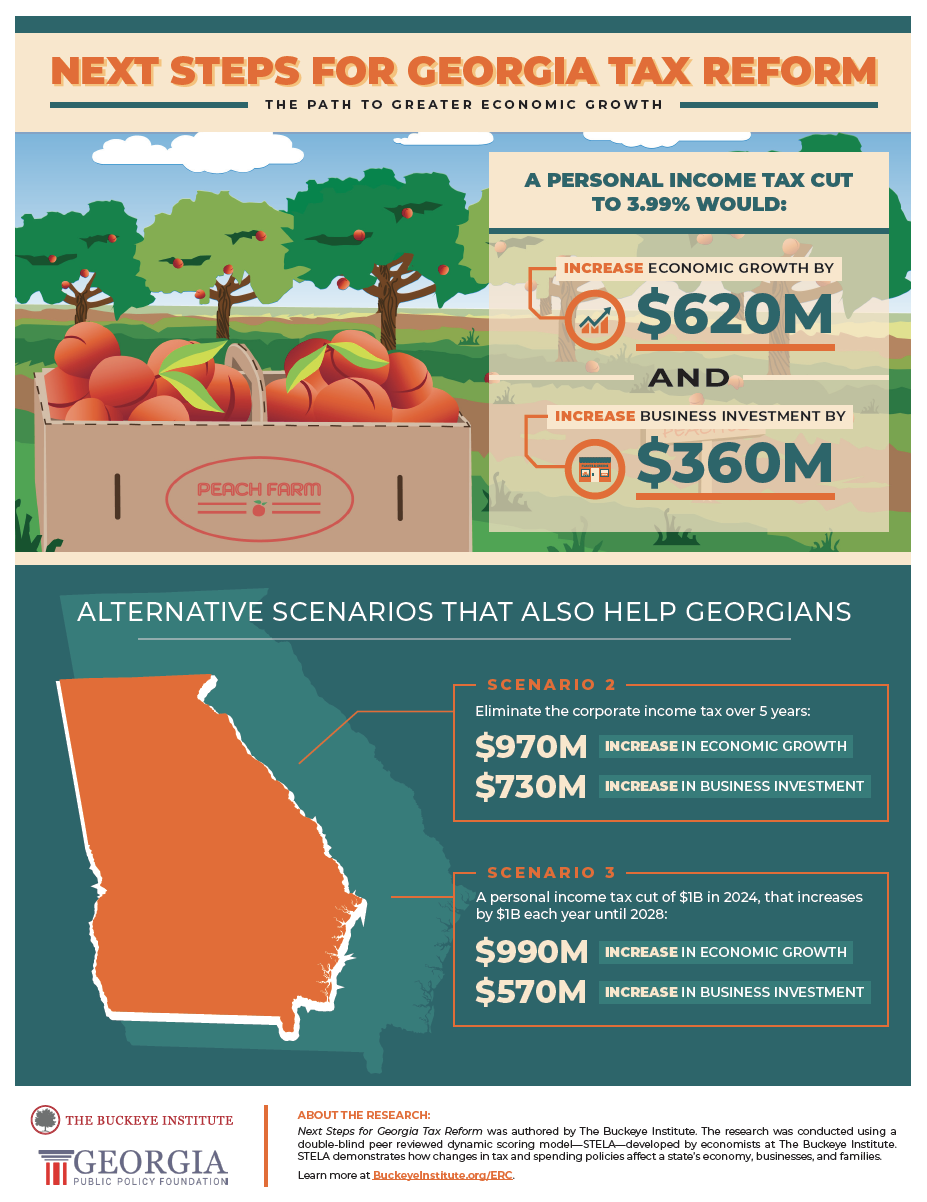

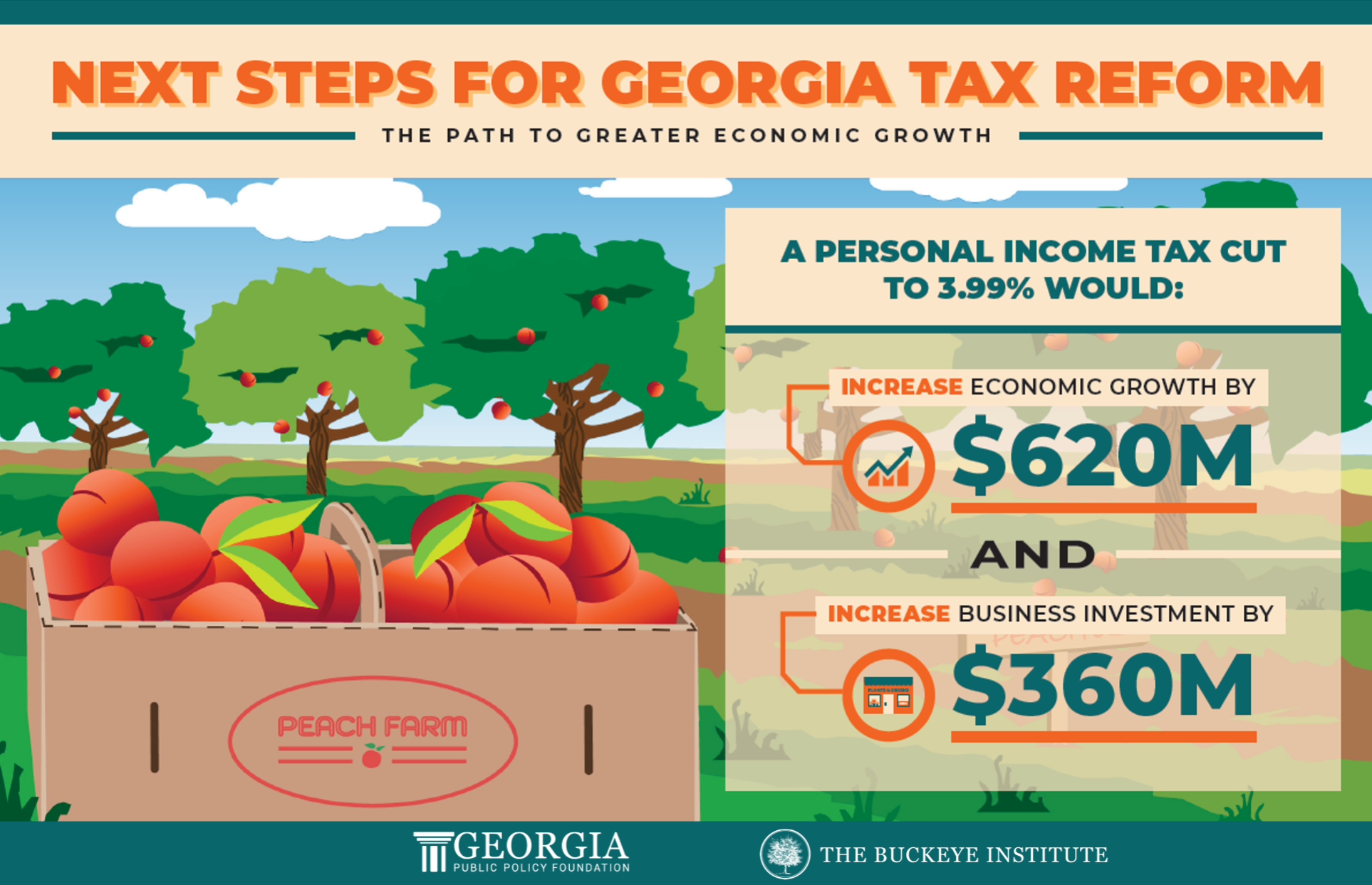

Scenario 1: An incremental personal income tax cut to 3.99 percent by 2030 generates:

- $620 million in economic growth;

- $360 million in business investment;

- $170 million in consumer spending; and

- 2,000 new jobs in the first year.

By 2030, after fully implementing the income tax cut, Georgia will have experienced:

- $5.10 billion in economic growth;

- $3.27 billion in business investment;

- $1.43 billion in consumer spending; and

- 16,000 new jobs.

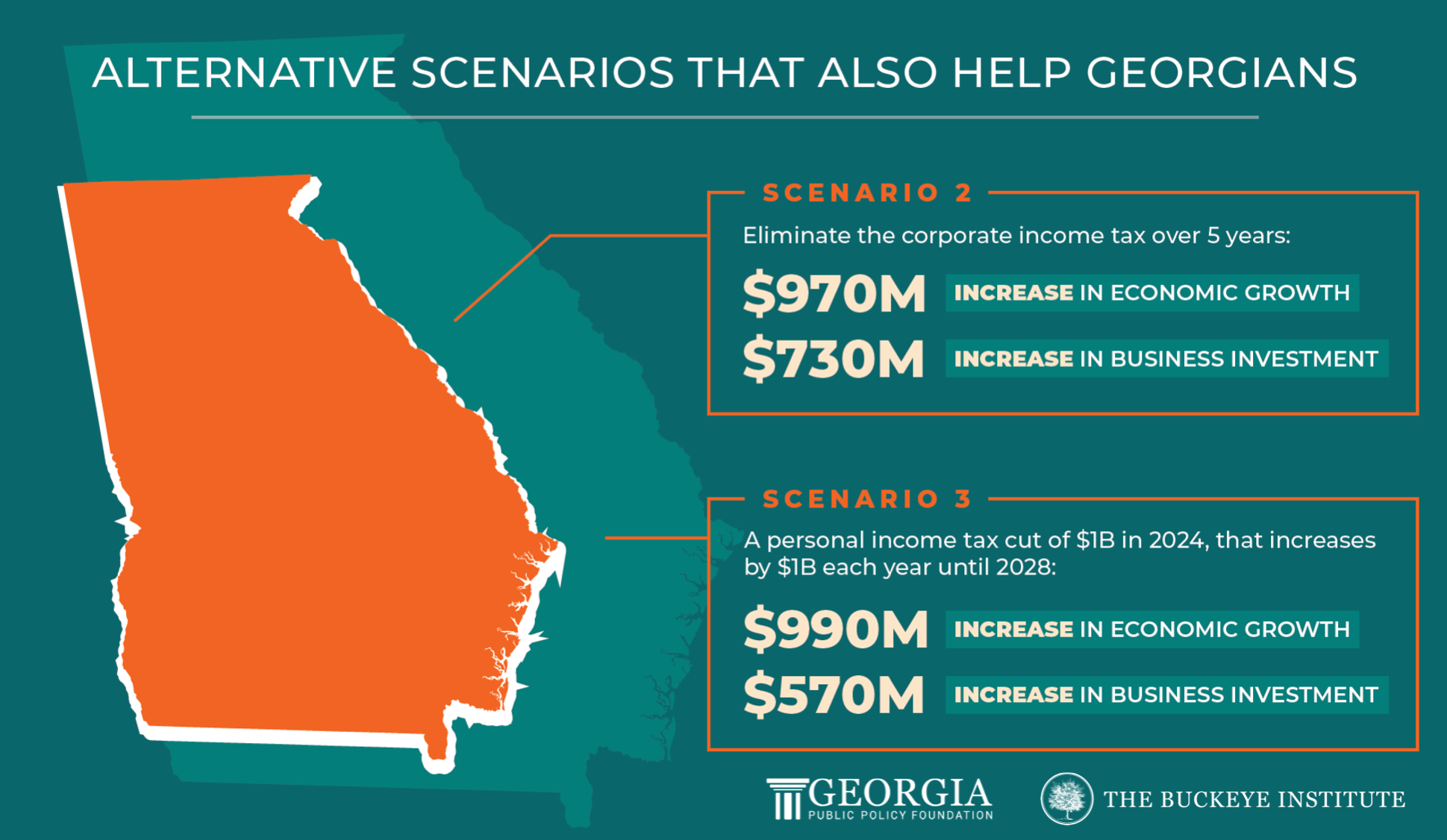

Scenario 2: Eliminating the corporate income tax over five years generates:

- $970 million in economic growth;

- $730 million in business investment;

- $40 million in consumer spending; and

- 2,000 new jobs in the first year.

By 2028, after eliminating the corporate income tax, Georgia will have experienced:

- $5.47 billion in economic growth;

- $4.40 billion in business investment;

- $270 million in consumer spending; and

- 10,000 new jobs.

Scenario 3: A $5 billion personal income tax cut over five years generates:

- $990 million in economic growth;

- $570 million in business investment;

- $280 million in consumer spending; and

- 4,000 new jobs in the first year.

By 2028, after implementing the tax cut, Georgia will have experienced:

- $5.58 billion in economic growth;

- $3.43 billion in business investment;

- $1.55 billion in consumer spending; and

- 18,000 new jobs.

Scenario 4: A $500 million personal income tax rate reduction and elimination of tax credits returns no money to taxpayers, generating no additional economic growth, business investment, consumer spending, or job gains.

The authors of Next Steps for Georgia Tax Reform are Rea S. Hederman Jr., executive director of the Economic Research Center and vice president of policy at The Buckeye Institute; Zachary D. Cady, an associate economist at The Buckeye Institute; and Trevor Lewis, an economic research analyst at The Buckeye Institute.

Consistent with academic standards and methodologies, STELA underwent a double-blind peer review. A full methodology and technical description are available in the report’s appendix, allowing researchers to validate STELA’s accuracy and conclusions.

# # #