The Buckeye Institute Testifies on the Economic Impact of Ohio’s RPS

Jan 10, 2018Columbus, OH – The Buckeye Institute’s Greg R. Lawson testified today (see full text below or download) before the Ohio Senate Energy and Natural Resources Committee on the economic impact of Ohio’s renewable portfolio standards (RPS), which House Bill 114 sets as voluntary goals and allows customers to opt out of the program.

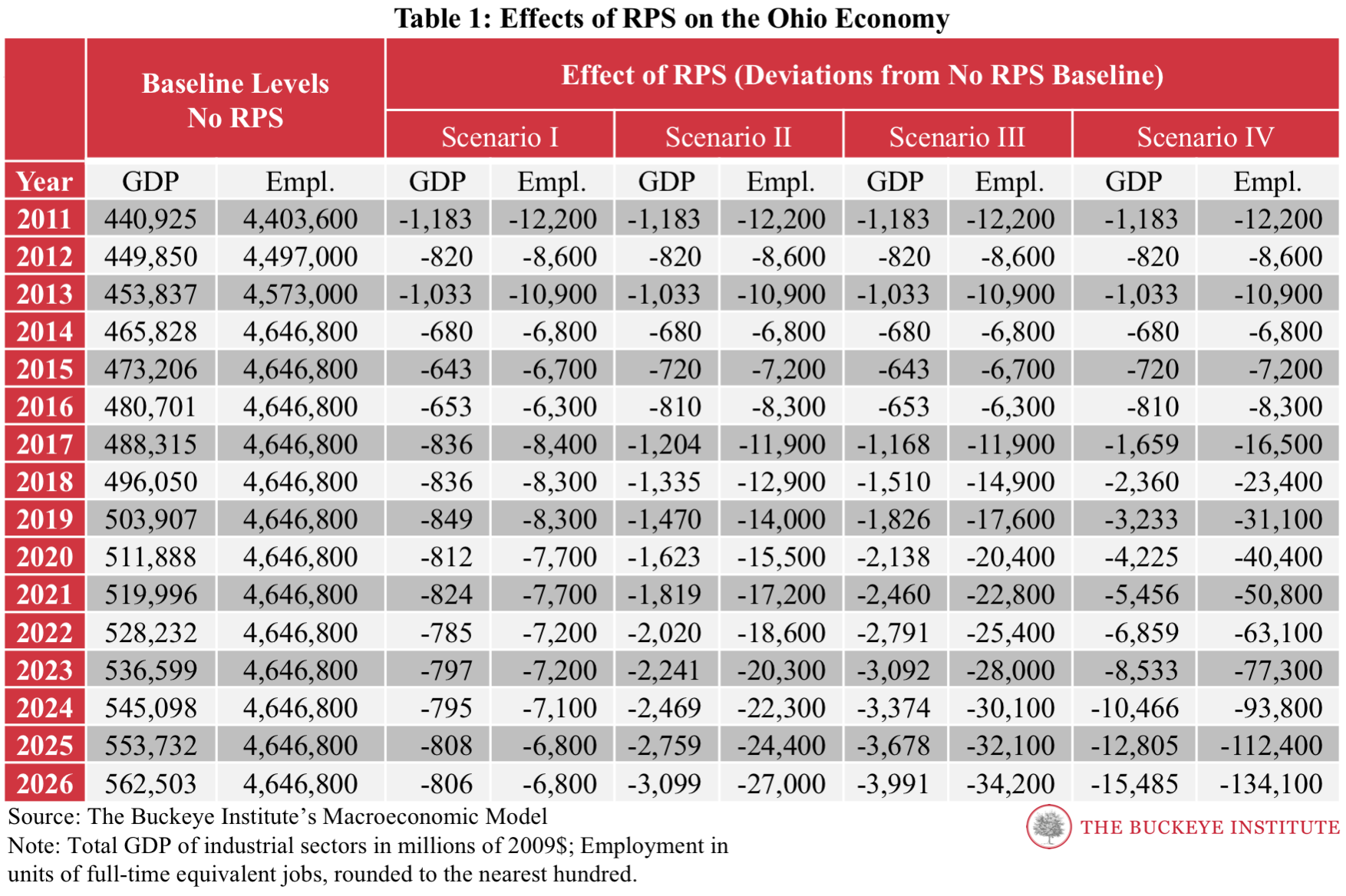

In his testimony, Lawson outlined the findings of research conducted by The Buckeye Institute’s Economic Research Center in its report, The Impact of Renewables Portfolio Standards on the Ohio Economy. Using a dynamic macroeconomic model, developed by economists at The Buckeye Institute, researchers looked at the impact changes to the RPS would have on the state’s economy and job growth. The four scenarios being considered by the legislature at the time were (see the appendix at the end of the testimony for results):

- Scenario I assumed the RPS remained suspended at 2014-2016 levels indefinitely and that renewable energy credits prices stayed constant at 2014 levels.

- Scenario II assumed the RPS was suspended indefinitely at 2014-2016 levels and that renewable energy credits prices gradually rose from 2014 levels to their historical maximum in 2026.

- Scenario III assumed the RPS mandates increased to 12.5 percent in 2026 and that renewable energy credits prices stayed constant at 2014 levels.

- Scenario IV assumed that the RPS mandates increased to 12.5 percent in 2026 and that renewable energy credits prices gradually increased from 2014 levels to their historical maximum in 2026.

Of the report’s findings, Lawson stated, “We merely illustrate the economic impact of the RPS mandate under both high- and low-cost scenarios informed by historical data from the Public Utilities Commission of Ohio. Whether compliance costs are high or low in the future, however, we predict that RPS ultimately will reduce GDP and employment growth.”

# # #

Interested Party Testimony on House Bill 114

Before the Ohio Senate Energy and Natural Resources Committee

Greg R. Lawson, Research Fellow

The Buckeye Institute

January 10, 2018

Chairman Balderson, Vice Chair Jordan, Ranking Member O’Brien, and members of the Committee. My name is Greg R. Lawson, I am the research fellow at The Buckeye Institute for Public Policy Solutions, a free-market think tank here in Columbus that advocates for low-tax, low-regulation policies for Ohio.

In a report we issued last year,[1] The Buckeye Institute’s Economic Research Center used a dynamic macroeconomic model to study the potential effects of Ohio’s RPS program under four different scenarios. Using historical data, we calculated the percent increase in electricity prices caused by the cost of RPS compliance. Under the RPS, electricity providers purchase renewable energy credits—or RECs—which add expenses above and beyond the cost of buying and distributing wholesale electricity. Providers pass that additional cost on to consumers. Thus, RPS functions very much like a tax on electricity by increasing the product’s price without providing the consumer with any additional benefit or value. Our economic model applied past and projected price increases caused by RPS to estimate the effect of this “tax” on state GDP and employment growth. The analysis revealed that RPS reduces Ohio’s GDP and curbs job growth across the state.

If, for example, the mandates resume to 12.5 percent and the price of renewable energy credits increases to historical highs, we expect employment to fall 2.9 percent and the state’s GDP to decline by 2.8 percent. Such reductions will mean 134,000 fewer jobs in Ohio. Even if REC prices remain constant at historical lows as the mandates resume to 12.5 percent, Ohio will employ 34,200 fewer people and produce nearly $4 billion less output by the final year of compliance.[2] Such ominous projections strongly support repealing the RPS mandate.

By using a simple methodology, our model’s results do not rely on elaborate assumptions. We merely illustrate the economic impact of the RPS mandate under both high- and low-cost scenarios informed by historical data from the Public Utilities Commission of Ohio. Whether compliance costs are high or low in the future, however, we predict that RPS ultimately will reduce GDP and employment growth. Our report estimates the RPS program’s economic impact under four scenarios, which are all measured against a baseline estimate that assumes no RPS costs at all. These scenarios are explained more fully in the appendix attached to my remarks.

Our conclusion that RPS mandates raise electricity prices and reduce job growth—particularly in energy-intensive industries such as manufacturing—should not be controversial. In fact, Governor John Kasich summarized our view rather neatly when he rhetorically asked last year:

“[Do] [y]ou want to bring more jobs back…in things like manufacturing?” And then answered: “[Then] [y]ou better have the cheapest energy you can have in the world. Do you know how much these alternative energies cost? A lot more than our traditional energy sources.”[3]

Advocates of the RPS mandates contend that the program’s economic costs and losses are offset by increasing investments and job growth in the renewable energy sector. Our model accounts for such green job growth. By using Ohio’s historical RPS, electricity, and employment data, our model picks up green job growth and changes to non-green sectors attributable to the mandate. We find that green job growth was more than offset by losses in other sectors.

This should not be surprising for several reasons. First, considering Ohio electricity providers can purchase RECs from out-of-state resources. Second, Ohio-based renewable energy companies can sell goods and services to other states and thus maintain employees in Ohio regardless of Ohio policy. Third, the RPS subsidy from REC purchases is relatively small compared to numerous federal tax credits and subsidies. And finally, there are simply far more other sector jobs than green jobs.

To be sure, some prior studies claim to have found economic benefits from RPS programs. Our model and analysis, however, better reflects the likely economic effects of the policy because it is strictly tailored to the renewable mandate and does not conflate RPS costs with reduced bills from energy-efficiency mandates. Moreover, our fully documented and transparent model is dynamic, and does not rely on a static input-output analysis.

Dynamic economic models are better suited than static input-output models for assessing the potential economic impacts of policies like RPS. Input-output models fail to account correctly for behavioral changes such as the effects that a price increase has on electricity demand and total output—especially in energy-intensive industries. In other words, static input-output models incorrectly assume that green jobs will be created without taking resources away from other, non-green sectors of the economy. In theory, however, the increase in electricity prices caused by the RPS should force job losses and reductions in hiring growth in other sectors that do not receive the benefits of the mandate—and our findings confirm that theory. Thus, unlike other studies, our analysis accounts for economic realities rather than assuming or wishing them away.

One of those realities is that the RPS raises electricity prices for businesses, costing them money that they might have otherwise spent producing goods and creating jobs. Our model research demonstrates that RPS mandates will cost more future jobs and GDP than they will create through renewable energy subsidies. As such, we must face the cold economic fact that continuing Ohio’s “march up Mandate Mountain” will cost thousands of future jobs and billions of dollars. To escape that end, Ohio must eliminate the RPS mandate and retreat from that fateful march.

Appendix

The Buckeye Institute’s estimate the RPS program’s future economic impact under four scenarios.

- Scenario I assumed the RPS remained suspended at 2014-2016 levels indefinitely and that renewable energy credits prices stayed constant at 2014 levels.

- Scenario II assumed the RPS was suspended indefinitely at 2014-2016 levels and that renewable energy credits prices gradually rose from 2014 levels to their historical maximum in 2026.

- Scenario III assumed the RPS mandates increased to 12.5 percent in 2026 and that renewable energy credits prices stayed constant at 2014 levels.

- Scenario IV assumed that the RPS mandates increased to 12.5 percent in 2026 and that renewable energy credits prices gradually increased from 2014 levels to their historical maximum in 2026.

These four scenarios are measured against a baseline estimate without RPS costs. That baseline provides a counterfactual that predicts what the Ohio economy would have looked like without an RPS in place, and what the economy would likely become if the RPS were repealed entirely.

[1] Orphe Divounguy, Ph.D., Rea S. Hederman Jr., Joe Nichols, and Lukas Spitzwieser, The Impact of Renewables Portfolio Standards on the Ohio Economy, The Buckeye Institute, March 3, 2017.

[2] REC prices likely will rise for three reasons. First, demand for RECs will grow as (1) annual compliance targets increase in states with existing RPS laws, (2) many states (e.g., New York and California) seek to increase existing or implement new RPS targets, and (3) companies (e.g., Amazon and Facebook) seek to “offset” more of their fossil fuel- and nuclear-generated electricity with renewables. Second, the demand for RECs will likely outpace the supply of renewable energy, causing REC prices to rise. Building new renewable generation sources greatly depends on federal tax credits and subsidies—and the most significant of those are scheduled to sunset within the next three to seven years (i.e., 2020 for wind, and 2024 for solar). The Trump Administration appears unlikely to support new federal regulations or subsidies favoring renewable generation investments. Finally, by regulation, Ohio electricity providers may only purchase RECs produced by renewable energy generators located in Ohio or her neighboring states. Ohio’s REC supply is further constrained because her bordering states also rank well below-average in renewable energy potential and therefore are not strong candidates for future renewable energy investments.

[3] Emily Atkin, “Kasich Bashes Clean Energy and Climate Action At Ohio Town Hall,” ThinkProgress, March 14, 2016.