A Far from a PURRFect Tax: Revisiting the CAT

Sep 26, 2017

Today, the Tax Foundation released a new report that delves deeply into Ohio’s commercial activities tax, or CAT, its history and its mechanics.

This is the second report from the Tax Foundation that focuses on Ohio. Earlier this year, The Buckeye Institute partnered with the foundation to release Ohio Illustrated: A Visual Guide to Taxers and the Economy. This book shows Ohio policymakers, as well as regular Ohioans, how the state’s overall tax system operates in an easy to understand format – not something easily done when talking about taxes!

This new report, Ohio’s Commercial Activity Tax: A Reappraisal, goes into greater detail on the CAT. Ultimately, the report shows exactly why the CAT is a far from perfect tax and why other states, that may consider implementing a similar tax, should be wary. However, the report also highlights why the CAT, despite its obvious problems, is more tolerable in Ohio than it would likely be in many other states.

To understand this, one has to take the Tardis time machine and go back to the genesis of the CAT.

In 2005, the Taft Administration and the Ohio General Assembly embraced one of the largest overall tax reforms in state history. Ohio was burdened with an outdated, and easily gamed corporate franchise tax and a tangible personal property (TPP) tax. For years, the business community made clear that those taxes were major hurdles to Ohio becoming more competitive nationally when it came to creating jobs.

Thus, the CAT was intended to be a broad-based, low rate tax that, unlike the corporate franchise and TPP taxes it replaced. The CAT would limit the ability of businesses to game the system or stick it to competitors that failed to have the best accountants and consultants, money could buy.

Since the implementation of the CAT, there have been a series of controversies. Paramount among these is the fact that the CAT has widely varying and disparate impacts depending on the type of business it is being subjected to.

Some businesses, such as a big steel manufacturing company, barely feel the CAT’s bite while for others, such as a small-scale microbrewery, the CAT draws all too much blood. Under the CAT, it is also possible for a company to lose money yet still be forced to pony up to the taxman. This is economically harmful!

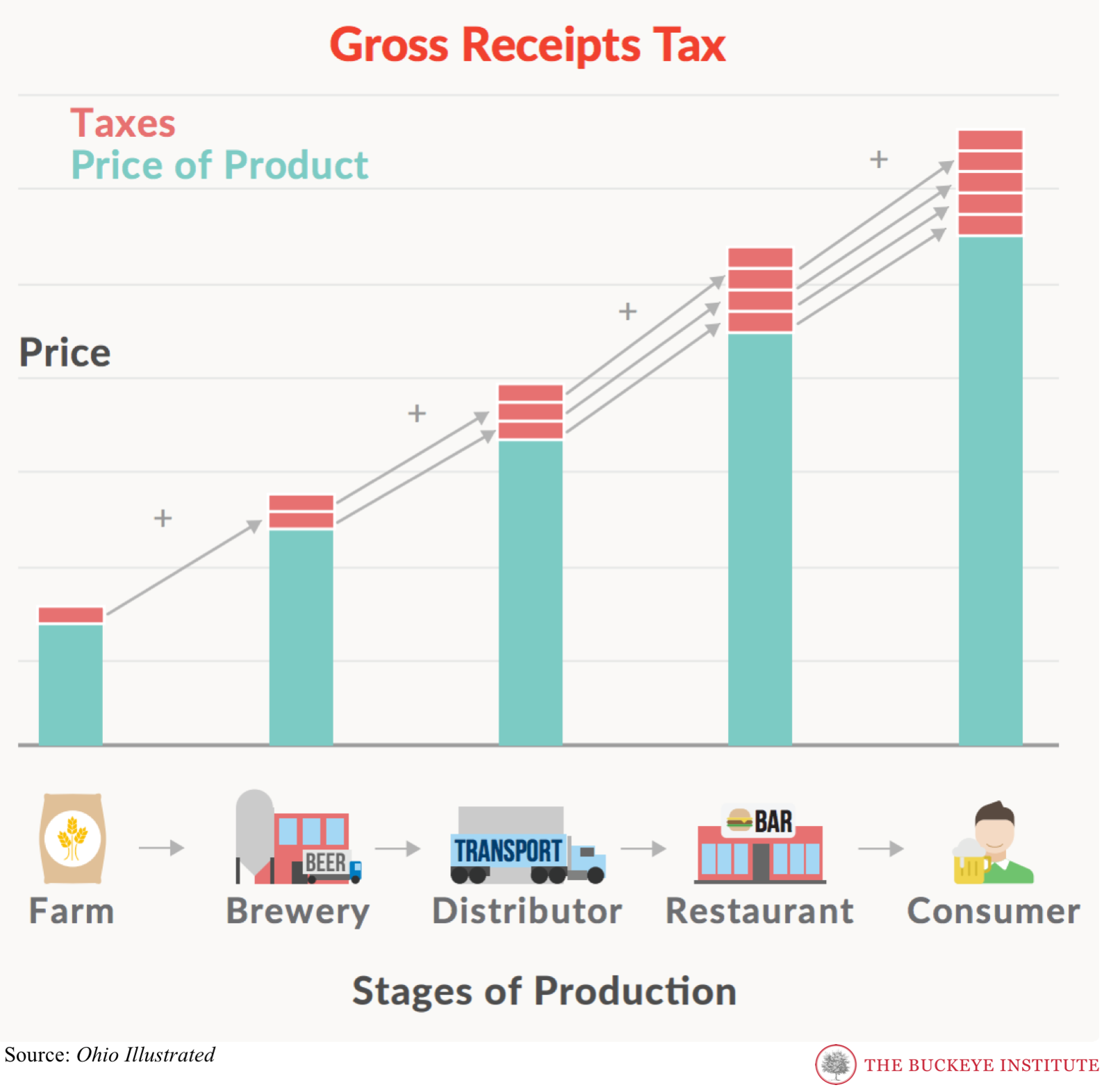

It also violates The Buckeye Institute’s Tax Reform Principles for Ohio. Even at the low statutory rate of .26 percent, the fact that this is applied on every transaction a business conducts means that beyond its particularly bad impact on businesses that may be losing money, it pyramids on itself, as the graphic below shows.

Overall, the business community has largely acquiesced to the CAT in Ohio so long as the rate remains low. Efforts to raise this rate, as Governor Kasich has attempted to do in past budgets (though, fortunately, not the current one) have been met with blanket opposition, including from The Buckeye Institute.

Other states that look at imposing similar gross receipts tax should not take this as an endorsement of the CAT as good tax policy. Far from it.

Had Ohio not been burdened by particularly pernicious taxes, it would be difficult to envision a scenario where the CAT would have earned the acceptance of the business community. Further, many states that have considered implementing the CAT have thrown around much higher rates that would devastate future economic growth, including in Louisiana The Buckeye Institute found:

“…would cause the most pain for least gain, reducing employment by more than 11,000 jobs, and would generate only around $260M in tax revenues. When tested, the CAT caused the biggest drop in the state’s economy and withdrawing it from consideration was the right decision by the legislature.”

The CAT is far from a perfect tax, and Ohio should look to replace it with a more pro-growth tax system that eliminates tax loopholes and subsidies. Until we do though, other states should avoid copying Ohio by adopting a CAT, your outcomes will be far worse than ours.

Greg R. Lawson is the research fellow at The Buckeye Institute.