How Tax Reform Will Affect Ohio’s Families

Nov 28, 2017

Talk of tax reform has been everywhere recently, with many different opinions being voiced as both the U.S. House (passed on November 16) and Senate (still being debated) have released their own versions of the Tax Cuts and Jobs Act in the past several weeks.

Like many other attempts for political reform, this tax bill will see more changes and compromise before it is officially passed. With this in mind, let’s take a look at two main ways this initial proposal will impact you, your family, and your fellow Ohioans.

If you are interested in a more comprehensive comparison of the two tax reform proposals, check out this chart by the Tax Policy Center.

Individual Income Taxes

Individual tax rates for low- and middle-income Ohioans (households making less than $104,670) will go down and be simplified in the House and Senate versions of the bill (this could still change in the Senate version as they have not passed their bill yet). This means that a family of four earning $50,000 would pay $0 under the House bill, while under the current tax code they would pay a $233, a savings of $233.

So, while not a lot of money, this means even without a raise, you will be taking home more in each paycheck to spend on the things that are important to you and your family.

In addition, this basic (or static as it is called in economic terms) analysis does not take into consideration the additional economic growth that will result from tax reform. A more dynamic analysis from the Tax Foundation, estimates that the House proposal will add 33,736 full-time jobs to Ohio by 2027 and add $2,051 to the paychecks of working families. The Senate proposal would add 35,063 jobs with a $2,375 increase in working family paychecks.

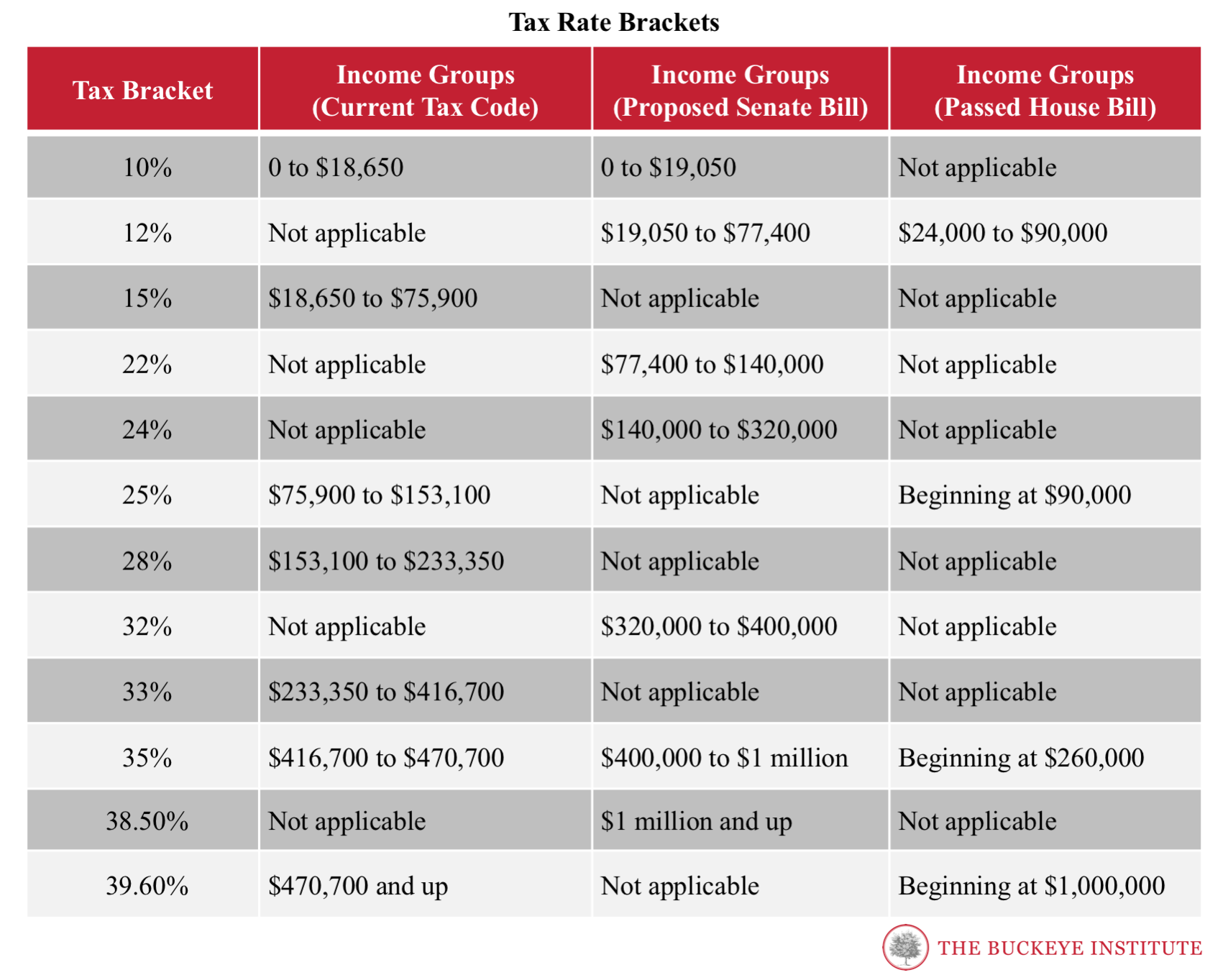

Another positive reform, included in both the House and Senate versions, is reduction in the number of tax brackets, as the chart below shows. The House bill reduces the current number of brackets from seven to four, while the Senate version retains seven brackets, but reduces the rates in the lower- and middle-income ranges.

Itemized Deductions vs. Standard Deductions

There has also been a lot of conversation around raising the standard deduction and the elimination of some deductions currently in the tax code. Unfortunately, the debate often makes things more confusing, so let’s see if we can make a bit more sense out of it.

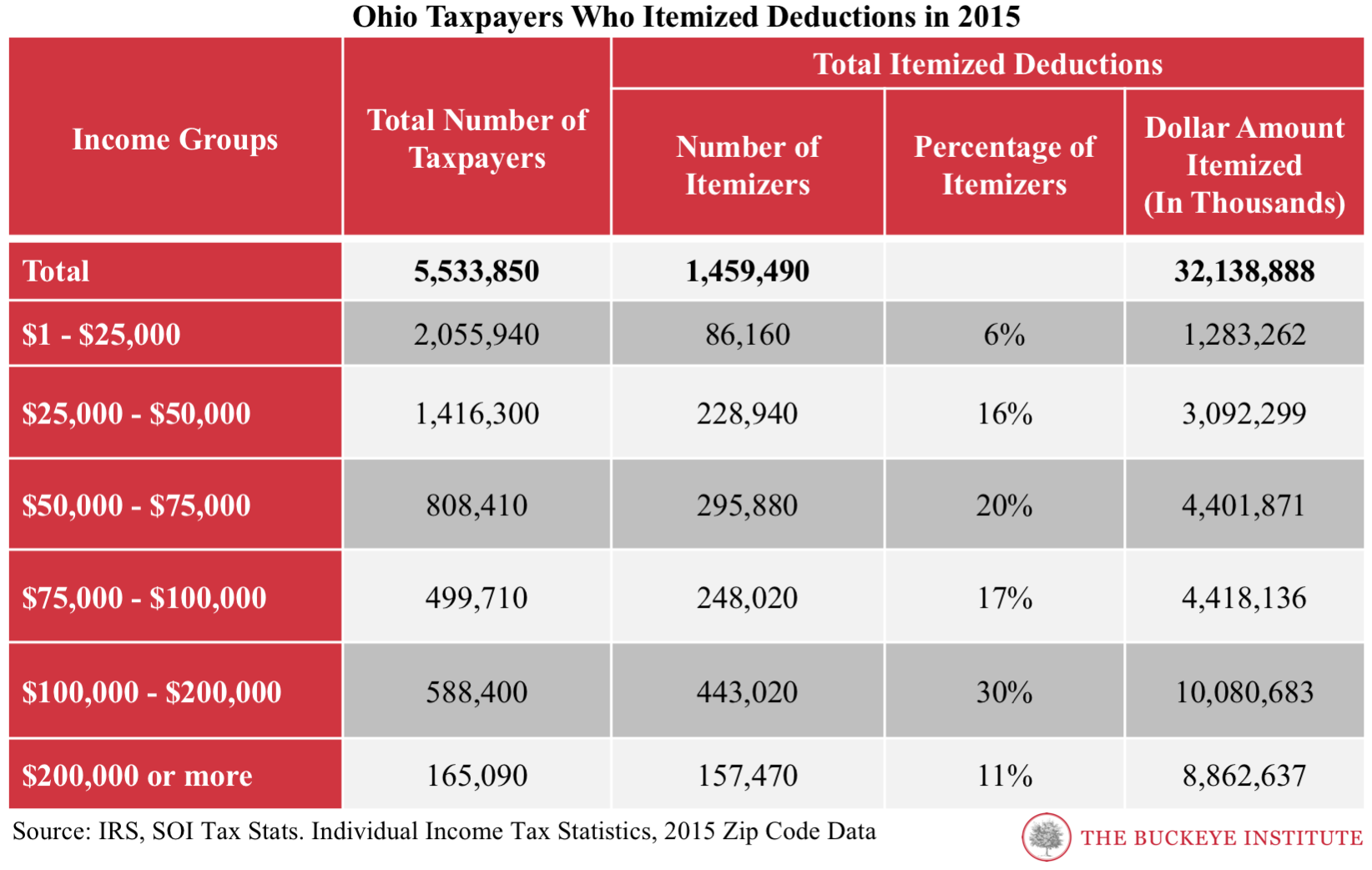

As of 2015, according to IRS data, 1,459,490 tax filers in Ohio itemized their deductions on their taxes. This is just over 26 percent of all taxpayers in the state.

Under the current tax code the standard deduction for a married couple is $12,700, under the House and Senate bills it nearly doubles going up to $24,000 ($6,350 to $12,200 for singles; $9,350 to $18,300 for heads of household).

So, once you have added up all the deductions you are eligible for, you decide if itemizing is in your best interest or if taking the standard deduction is better for you. And, as the chart above shows in 2015, when the deduction was half the amount proposed in the House and Senate bills, more than 70 percent of Ohioans decided taking the standard deduction was in their best interest.

Where this gets tricky is when we look at what happens to the state and local tax deductions (known as SALT), which includes 1) state income taxes, 2) local income taxes, 3) general sales tax, 4) real property taxes, and 5) personal property taxes.

Currently under SALT, Ohioans who itemize are allowed to deduct either state income taxes or general sales taxes – just one, not both – and they can also deduct any real or personal property taxes from their federal taxable income.

Under the House bill SALT is partially repealed – they eliminated the deduction for state income taxes, local income taxes, and general sales tax; however, they retained the deduction for real and personal property taxes with a cap of $10,000.

The Senate version proposes a complete elimination of the SALT deduction.

While this has become a bone of contention for many states, it is important to remember that this deductible has become a subsidy for states as it enables states and local governments to hide the impact of higher taxes from their citizens. This occurs because as state and local governments raise taxes, Ohioans can deduct more from their federal taxes, thus not feeling the full force of the tax increase. While some may say, this isn’t a big deal, this type of deduction makes it harder for taxpayers (you and me) to hold state and local governments accountable for the taxes they are raising.

Furthermore, it means Ohioans are subsidizing high tax states like New York, New Jersey, and California. In fact, according to the Tax Foundation, “California, New York, New Jersey, Illinois, Texas, and Pennsylvania—claim more than half of the value of all state and local tax deductions nationwide, with California alone responsible for 19.6 percent of the national tax expenditure cost.”

So, while on the surface, giving up this, and other deductions, might sound bad (I mean who wants to lose a deduction) the fact is Ohioans are subsidizing high taxes states with the current SALT deduction, state and local governments are able to hide the impact of their tax increases, and our current tax code is incomprehensible to most of us, which causes us time, money and stress every time we have to file.

As the federal policymakers continue the debate on federal tax reform, we must keep the end goal in site – lower taxes, a fairer system, and an easier to understand tax code. But reform doesn’t end in Washington, DC. Many of the reforms needed are at the state and local level, and Ohio policymakers, just as those in DC, need to undertake principled tax reform to create a state tax code that ensures economic growth, simplicity, transparency, fairness and equitability.

Quinn Beeson is the economic research analyst at The Buckeye Institute’s Economic Research Center.