Today is Tax Freedom Day in Ohio

Apr 12, 2013Tax reform continues to be a big issue in Ohio as the biennial budget debates continue. Regardless of what the final reform package might look like, everyone can agree we need to continue lowering the rates and allowing Ohioans across the board to keep what is theirs. To illustrate this point, consider that today is Tax Freedom Day in Ohio. That’s right, according to the non-partisan Tax Foundation, April 12 is the day where Ohioans will have finally earned enough to pay their overall tax bill from all levels of government.

Thanks to reforms Ohio has made in recent years, Buckeye State residents are finally clawing their way back into the bottom half of the tax burden. This year we rank 28th. Meanwhile, Californians (no surprise here) will be working nearly two more weeks to pay their tax bills off by April 24 and New Yorkers (again, no surprise) will be working all the way to May 6. Overall, the average Tax Freedom Day in the U.S. has crept up by five days since 2012 to April 18.

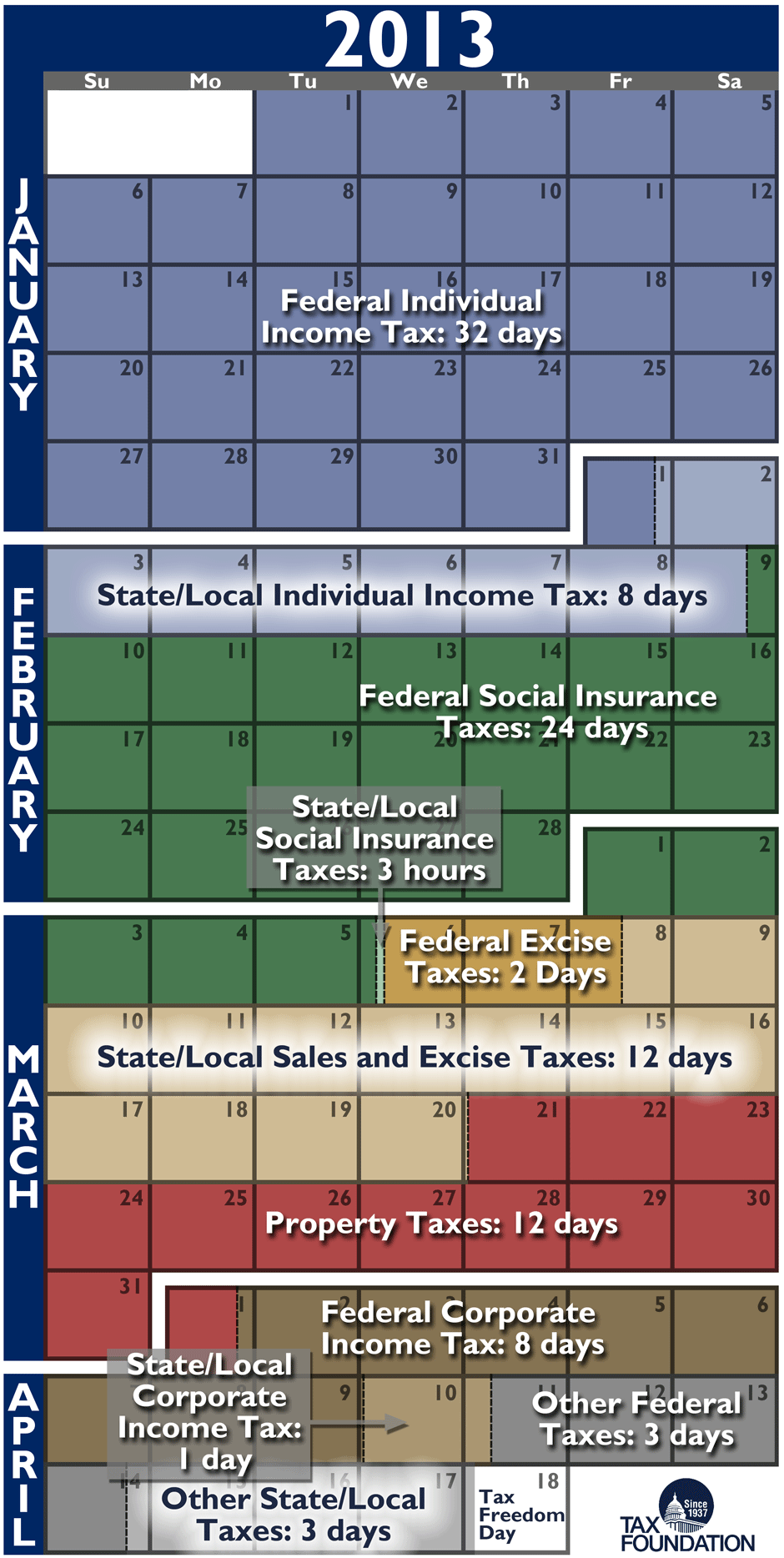

So why does it take so long for people in this country to pay off their tax bill? Simply put, it is because of the multiple layers of taxation everyone faces. Consider the myriad of different of forms taxation that we all pay:

- Federal, state and (especially in Ohio) local income taxes;

- Various social insurance taxes (Social Security, Medicare, unemployment);

- Federal, state and local excise taxes (like sales taxes);

- Corporate taxes;

- Capital gains taxes;

- Estate taxes (though thankfully no longer in Ohio); and

- Property taxes.

The graphic below does a good job of breaking these down by the average number of days Americans must work to pay for each type of tax.

As the Tax Foundation indicates, Tax Freedom Day moved back due to a combination of factors, especially income tax increases as part of the Fiscal Cliff deal and the deluge of new taxes coming online due to ObamaCare’s implementation.

While some level of taxation is obviously necessary, the longer we push Tax Freedom Day back, the less capital is available for more efficient allocation in the overall economy. This is where the Keynesians continue to fail by thinking that the bureaucrats in D.C. and Columbus know what to do better than individuals.

Unfortunately, the picture for economic freedom gets even darker if you factor in federal borrowing which really represents future taxes owed. That pushes the U.S. Tax Freedom Day twenty-one days later to May 9. Given that the latest “deficit included” Tax Freedom Day was at the height of World War II on May 21, 1945, this is astounding. We simply should not be running up debt in 2013 at similar rates to when we fought a world war to defeat fascism in 1945. Of course, we run the risk of further increasing that debt by signing onto any Medicaid expansion in Ohio.

The bottom line is that Ohioans, and all Americans, need to keep pushing fundamental tax reform so that we can grow our economy, get people to work, and free ourselves from onerous tax and debt burdens.