Trevor W. Lewis

New Buckeye Institute Economic Modeling Reveals Billions in Economic Growth Possible for Georgia

March 07, 2024

A new report, Next Steps for Georgia Tax Reform, by The Buckeye Institute, found that cutting taxes would lead to billions in economic growth and business investment in the Peach State. The Buckeye Institute partnered with Georgia Public Policy Foundation to conduct the research. “Georgia has undertaken several positive tax reforms that have spurred economic growth, but the state must continue to reform its tax policies if it wants to remain competitive.”

Let Open Road Renewables’ Data Speak for Itself

February 26, 2024

Open Road Renewables’ (ORR) property tax revenue estimates for the Frasier Solar project were made publicly available on January 8, 2024. The Buckeye Institute cannot vouch for ORR’s data, but is nonetheless providing an analysis using the ORR data in order to show an apples-to-apples comparison. After re-running The Buckeye Institute’s proprietary economic model using ORR data, Buckeye’s original conclusion stands: the PILOT program remains as not being a clear winner for Knox County or its taxpayers.

New PILOT Assumptions Still Flawed

February 12, 2024

Knox County needs property tax revenues today to help close its $950,000 budget deficit. Granting the solar farm its PILOT tax breaks will maintain that deficit and ensure that the county’s property taxpayers ultimately pay more in the future. Knox County officials should at the very least critically consider the fatal flaws in this latest analysis and act based upon realistic projections and sound calculations that account for the realities of inflation.

New Buckeye Institute Report Finds Net-Zero Climate-Control Policies Fail Farmers & Families

February 07, 2024

A new report, Net-Zero Climate-Control Policies Will Fail the Farm, released by The Buckeye Institute, found that America’s net-zero climate-control experiment has dire economic consequences for American farmers and families. The report comes just days after a coalition of agricultural commissioners in 12 of America’s leading farm states demanded that the country’s six largest banks come clean on their “involvement in NZBA [the United Nations’ Net-Zero Banking Alliance] and their net-zero goals.”

Highway to the Danger Zone? PILOT Program Set to Shortchange Taxpayers

December 14, 2023

Responding to The Buckeye Institute’s economic concerns regarding low statutory limits placed on a “green energy” PILOT program, Open Road Renewables has asserted that Frasier Solar’s PILOT is a “clear winner” for Knox County. To address these concerns, Buckeye modeled additional scenarios. Doing so only further supports the original conclusion that the PILOT program is not a “clear winner” for Knox County and that its commissioners should be mindful of the program’s short- and long-term tradeoffs.

New Buckeye Institute Economic Modeling Reveals Tax Cuts Would Grow Kansas Economy

December 07, 2023

A new report, Reforming Kansas Tax Policy, released Monday by the Economic Research Center (ERC) at The Buckeye Institute, found that cutting taxes in Kansas could lead to hundreds of millions in economic growth and business investment. The ERC partnered with Kansas Policy Institute to conduct the research. “With regional competition for businesses and workers, Kansas must revisit pro-growth tax reforms to keep the state economically competitive.”

Buckeye Research Casts Doubt on Value of Knox County’s Solar Deal for Taxpayers

November 21, 2023

Frasier Solar has promised Knox County residents that local schools and townships will receive more than a million dollars per year if the county declines to collect property taxes from Frasier’s solar farms. Given the size of the windfall, Knox County is eager to waive Frasier Solar’s property tax bill. However, an analysis by The Buckeye Institute shows that Ohio’s statutory maximum rates for such “payment-in-lieu-of-taxes” (PILOT) deals may well be too low for such a deal to make sense for the county’s taxpayers.

California’s Big Oil Lawsuit Bites the Hand that Feeds the State

October 13, 2023

At RealClearPolicy, The Buckeye Institute exposes California’s hostility to an oil and gas industry that Californians rely on for more than 70 percent of their energy needs. “Without big oil, California will soon be entirely dependent on expensive foreign crude. And for Governor Newsom, that seems to be a feature, not a bug. Joining a long series of misguided policies, pledges, and commitments, his lawsuit is just the latest skirmish in the state’s multi-theater war on U.S. oil.”

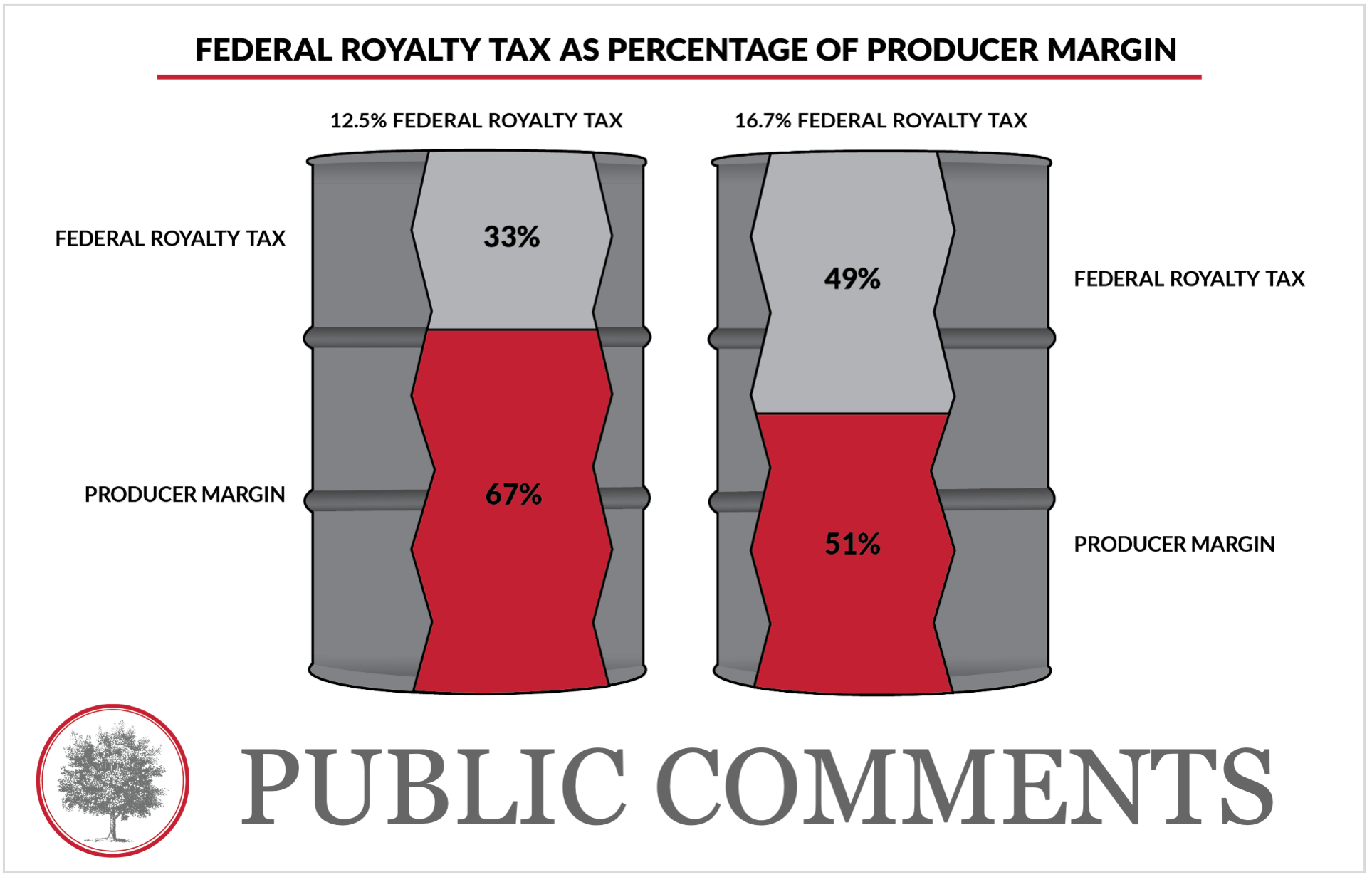

The Buckeye Institute: Proposed Fed Rule Would Increase Energy Prices, Risk U.S. Energy Security

September 22, 2023

As Americans face ever higher prices at the gas pump, The Buckeye Institute filed public comments detailing how a proposed U.S. Bureau of Land Management rule would lead to higher energy prices and risk U.S. energy security. “Americans are already paying record prices at the pump, and the Biden administration’s proposed rule will only increase prices further, making it harder for struggling Americans to make ends meet.”

Lawmakers in Alaska face tough choices about how to best balance the state budget in the coming months.

August 24, 2023

In The Washington Times, The Buckeye Institute and the Center of the American Experiment look at the tough choices Alaska lawmakers face to balance the state’s budget. The authors write, “While the temptation may be strong to try to raise more money from the energy industry, even in conservative states, trying to plug the budget hole by taxing petroleum producers will inevitably backfire by reducing Alaska’s energy production.”