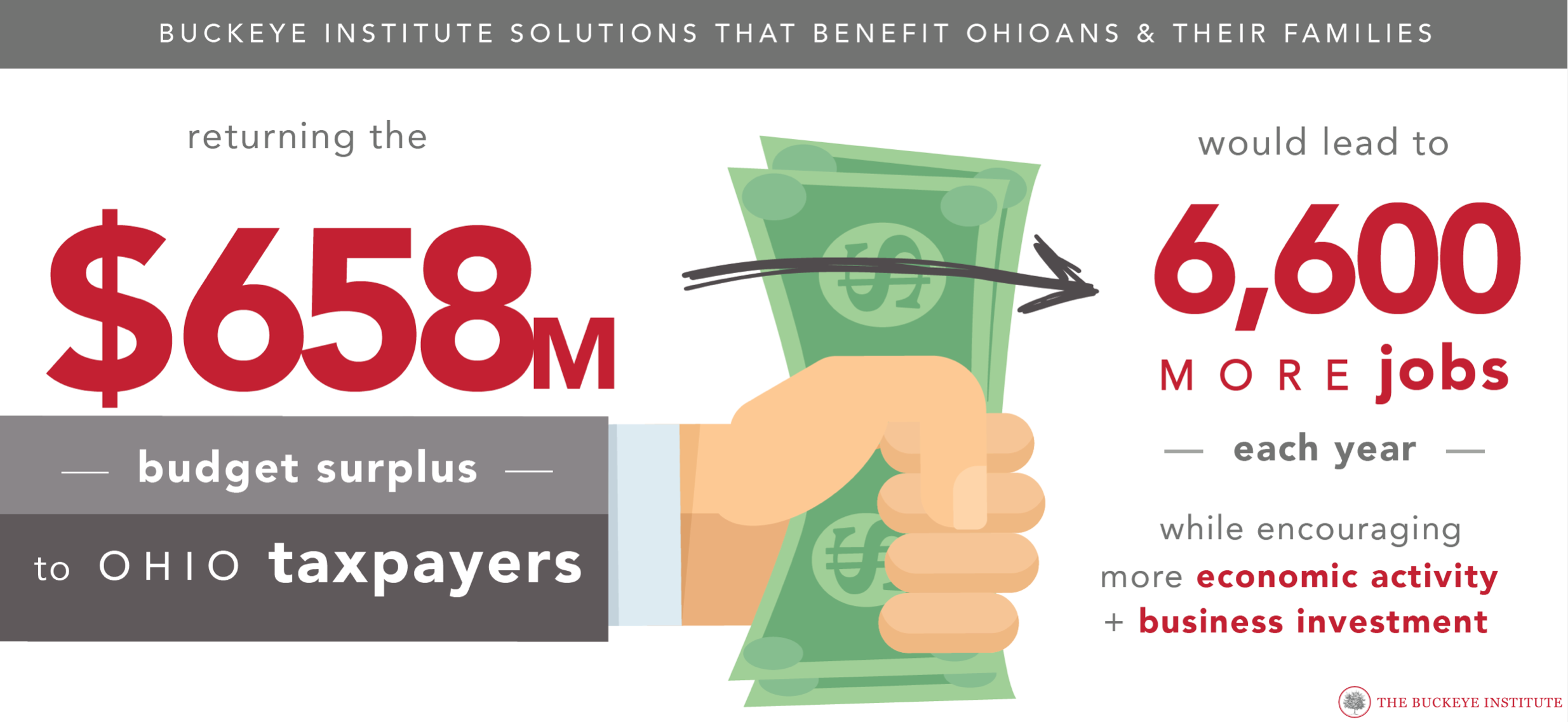

New Buckeye Institute Research Finds Returning $658 Million Surplus to Taxpayers Would Lead to 6,600 New Jobs Annually

May 20, 2019Columbus, OH – As the Ohio Senate continues its work on Ohio’s 2020-2021 biennial budget, The Buckeye Institute’s Economic Research Center released a new policy brief, How to Grow Ohio’s Economy: Return the Budget Surplus to Taxpayers, which found that returning $658 million to taxpayers—through permanent lower taxes— would lead to 6,600 more jobs annually.

“With a growing economy, Ohio now expects to end the fiscal year with a larger budget surplus of $658 million. While this is good news, it is critical for the state’s continued economic growth for policymakers to return the surplus to taxpayers though permanent tax cuts rather than succumbing to the temptation to increase government spending,” said Andrew J. Kidd, Ph.D., economist at the Economic Research Center at The Buckeye Institute and a co-author of the brief. “While the House budget provided some tax cuts, it still increases spending faster than inflation and population growth. By returning the entire surplus to taxpayers, the Senate would put Ohio on a path to create more than 6,000 new jobs, increase private sector investment, and keep Ohio’s economy growing.”

FACT SHEET: Sustaining Economic Growth: Return Ohio’s Budget Surplus to Taxpayers

How to Grow Ohio’s Economy builds on the research presented in Sustaining Economic Growth: Tax and Budget Principles for Ohio released in February 2019, which outlined four principles that policymakers should adhere to to maintain Ohio’s economic growth: 1) tax policy should promote economic growth and private investment; 2) tax codes should be simple, transparent, and make local governments more efficient; 3) budget surpluses should be saved or returned to taxpayers; and 4) budgets should grow proportionately with inflation and population.

How to Grow Ohio’s Economy was co-authored by Andrew J. Kidd, Ph.D., an economist with the Economic Research Center; and James B. Woodward, Ph.D., an economic research analyst with the Economic Research Center. The research was conducted using a dynamic scoring model developed by economists at the Economic Research Center that analyzes how changes to tax policy impact not only government revenues but also economic output, job creation, and business investment.

# # #