The Buckeye Institute: HB335 Will Help Ease Ohioans’ Property Tax Burdens

Nov 12, 2025Columbus, OH – On Wednesday, The Buckeye Institute submitted written testimony (see full text below or download a PDF) to the Ohio Senate Local Government Committee on the policies in Ohio House Bill 335, which, if adopted, will help ease property tax burdens on Ohioans.

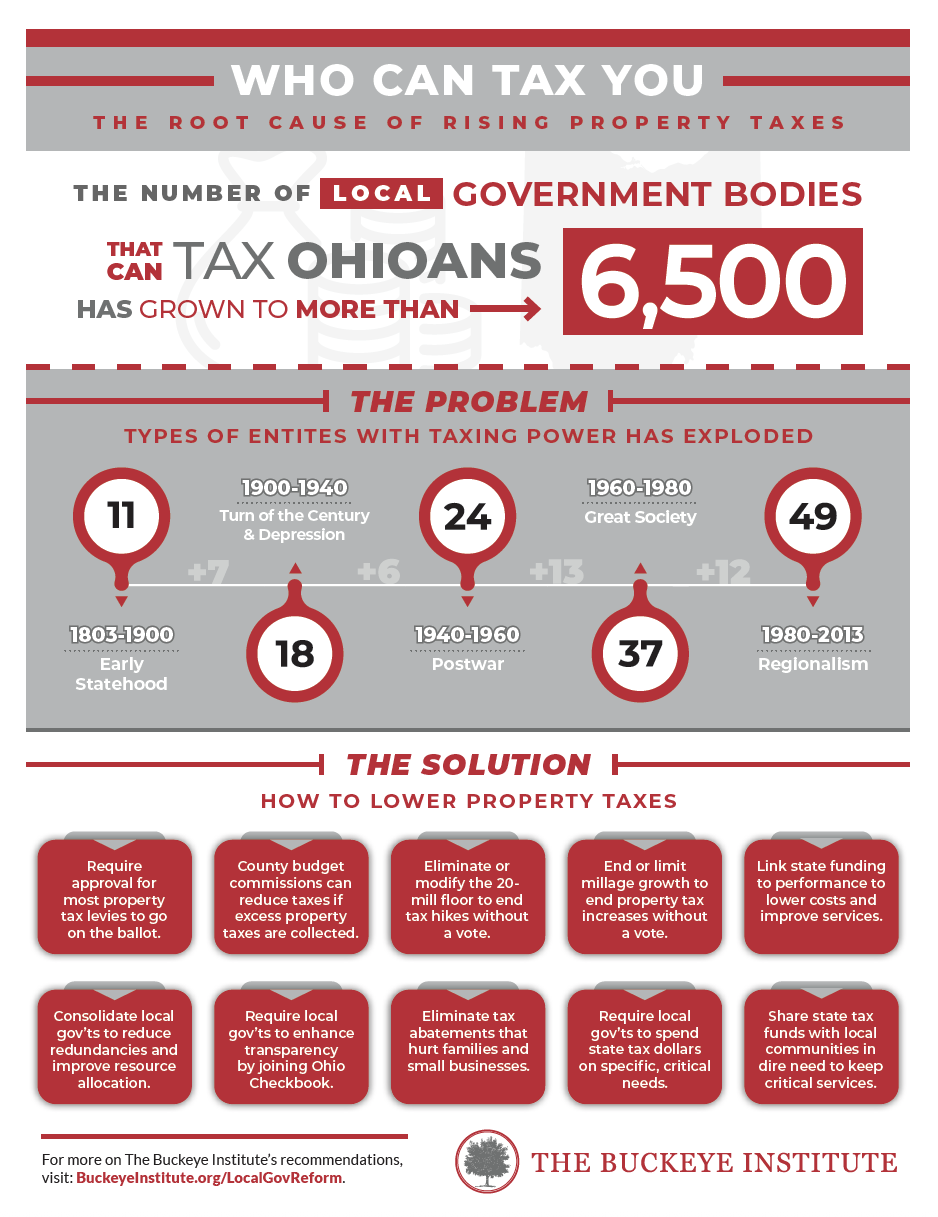

In his testimony, Greg R. Lawson, a research fellow at The Buckeye Institute, noted that Ohio’s complex municipal income tax structure imposes the “8th highest local tax burden” as a percentage of income in the nation and is a substantial reason that “homeowners and small businesses now routinely face unpredictable property tax spikes.”

Lawson went on to outline the most beneficial policies in the bill for over-taxed homeowners, most notably ending undemocratic policies that allow school districts and other political subdivisions to increase property taxes without voter approval. Lawson also urged lawmakers to reform local government, as recommended by The Buckeye Institute, to help ease property tax burdens on Ohioans.

In closing, Lawson recognized that the policies in House Bill 335 are “sorely needed to protect Ohio taxpayers from an outmoded, undemocratic system that has cost them dearly.”

Find more Buckeye Institute recommendations to reform local government and lower property taxes at BuckeyeInstitute.org/LocalGovReform.

# # #

Easing Ohioans’ Property Tax Burdens

Interested Party Testimony

Ohio Senate Local Government Committee

Ohio House Bill 335

Greg R. Lawson

Research Fellow

The Buckeye Institute

November 12, 2025

As Submitted

Chair O’Brien, Vice Chair Gavarone, Ranking Member Smith, and members of the Committee, thank you for the opportunity to submit written testimony regarding Ohio House Bill 335.

My name is Greg R. Lawson. I am a research fellow at The Buckeye Institute, an independent research and educational institution—a think tank—whose mission is to advance free-market public policy in the states.

Ohio’s property taxes and complex municipal income tax structure imposed the 8th highest local tax burden as a percentage of income in the nation in fiscal year 2022—up from 12th in fiscal year 2021. In addition to costs and inefficiencies created by a byzantine local government system, homeowners and small businesses now routinely face unpredictable property tax spikes spurred by historic inflation levels, leading some to openly call for abolishing property taxes altogether.

House Bill 335—the Property Tax Relief NOW Act—is one of the most significant property tax reform legislation since House Bill 920 passed in 1976. Without exploring every aspect of the legislation, I want to highlight what The Buckeye Institute foresees as most beneficial for over-burdened homeowners.

House Bill 920 created a cap, or reduction factor, on the increase of property taxes, but also allowed for the “20-mill floor,” which guarantees public school districts a minimum tax rate regardless of voter approval. This guarantee combines with various emergency levies and inside millage reallocations to allow school districts to collect millions of dollars in property taxes from homeowners every year without a vote.

House Bill 335 substantially changes Ohio’s inside millage, which is not subject to House Bill 920 reduction factors and can therefore be levied without prior voter approval. House Bill 335 essentially puts limits on the level of increase property taxpayers will have to pay due to inside millage. This bold departure from the status quo will immediately save Ohio taxpayers billions of dollars and face vociferous opposition from local governments that will soon have to make hard choices about their taxes and public services.

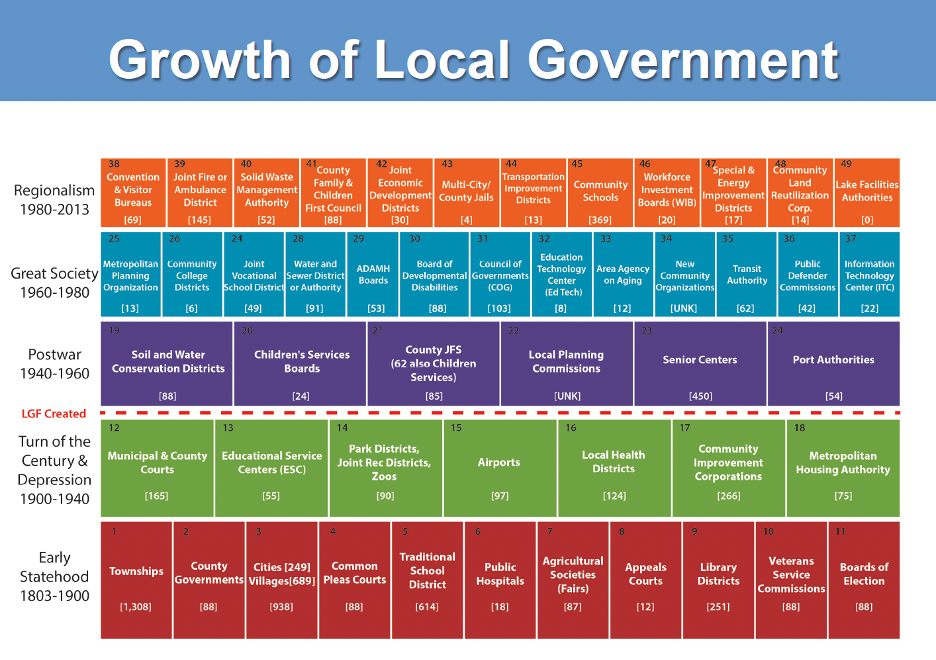

The Buckeye Institute continues to urge policymakers to ease property tax burdens by streamlining Ohio’s local government structure of more than 600 school districts and thousands of taxing entities. The graphic below, included in Governor Kasich’s Beyond Boundaries effort, shows the historical rise in Ohio taxing authorities up to 2013. And the number has continued to rise.

Should House Bill 335 be enacted, The Buckeye Institute continues to recommend eliminating unfunded state mandates that force local governments to raise taxes to meet Columbus’s demands, and advocates incentivizing local governments to share resources or consolidate to reduce excessive levies as counties and municipalities look to diversify their tax bases without inside millage. The Beyond Boundaries report and The Buckeye Institute have offered guidance for consolidation and service-sharing across jurisdictions that can save taxpayer dollars and make public services more efficient.

The Buckeye Institute commends Representative Thomas for introducing House Bill 335 and taking a decisive step toward a more efficient local government structure and property tax system. That step is sorely needed to protect Ohio taxpayers from an outmoded, undemocratic system that has cost them dearly.

Thank you for your time and attention.

# # #