Paying Income Taxes Could Be Worse

Apr 15, 2024To the IRS and state tax collectors, your money looks a lot like theirs—especially today, when tax returns and taxes owed are due. Writing checks for the government to cash always hurts, but it could be worse.

The Buckeye Institute has helped reduce state taxes in Ohio, and championed tax reforms with think tanks across the country to help spur growth and relieve tax burdens.

Ohio had a record budget surplus to start 2023, and policymakers focused on spending increases instead of tax cuts. But your Buckeye Institute convinced the General Assembly that tax reform and returning the budget surplus to taxpayers made more sense. Ultimately, Ohio eliminated two tax brackets and reduced its top marginal tax rate to 3.5 percent, saving taxpayers $2.5 billion during the budget cycle.

However, as National Review noticed, Buckeye’s Economic Research Center has helped other states, including Mississippi and Louisiana, fight for positive tax reforms. The Buckeye Institute partnered with allies in Georgia and Kansas to model pro-growth tax policies for legislators in their states, too.

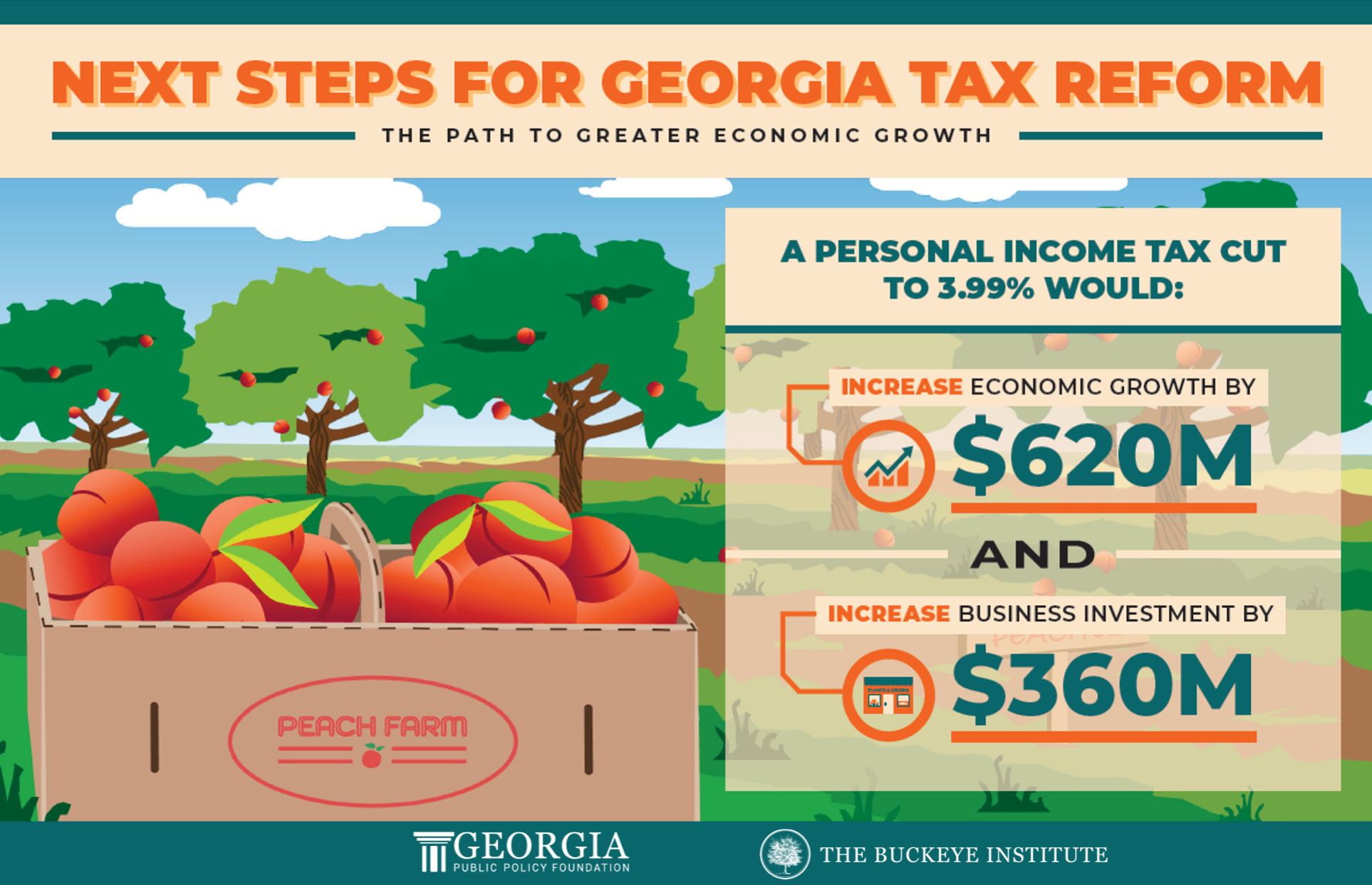

In Georgia, Buckeye’s economic analysts demonstrated that an incremental personal income tax cut to 3.99 percent by 2030 would generate:

- $620 million in economic growth;

- $360 million in business investment;

- $170 million in consumer spending; and

- 2,000 new jobs in the first year.

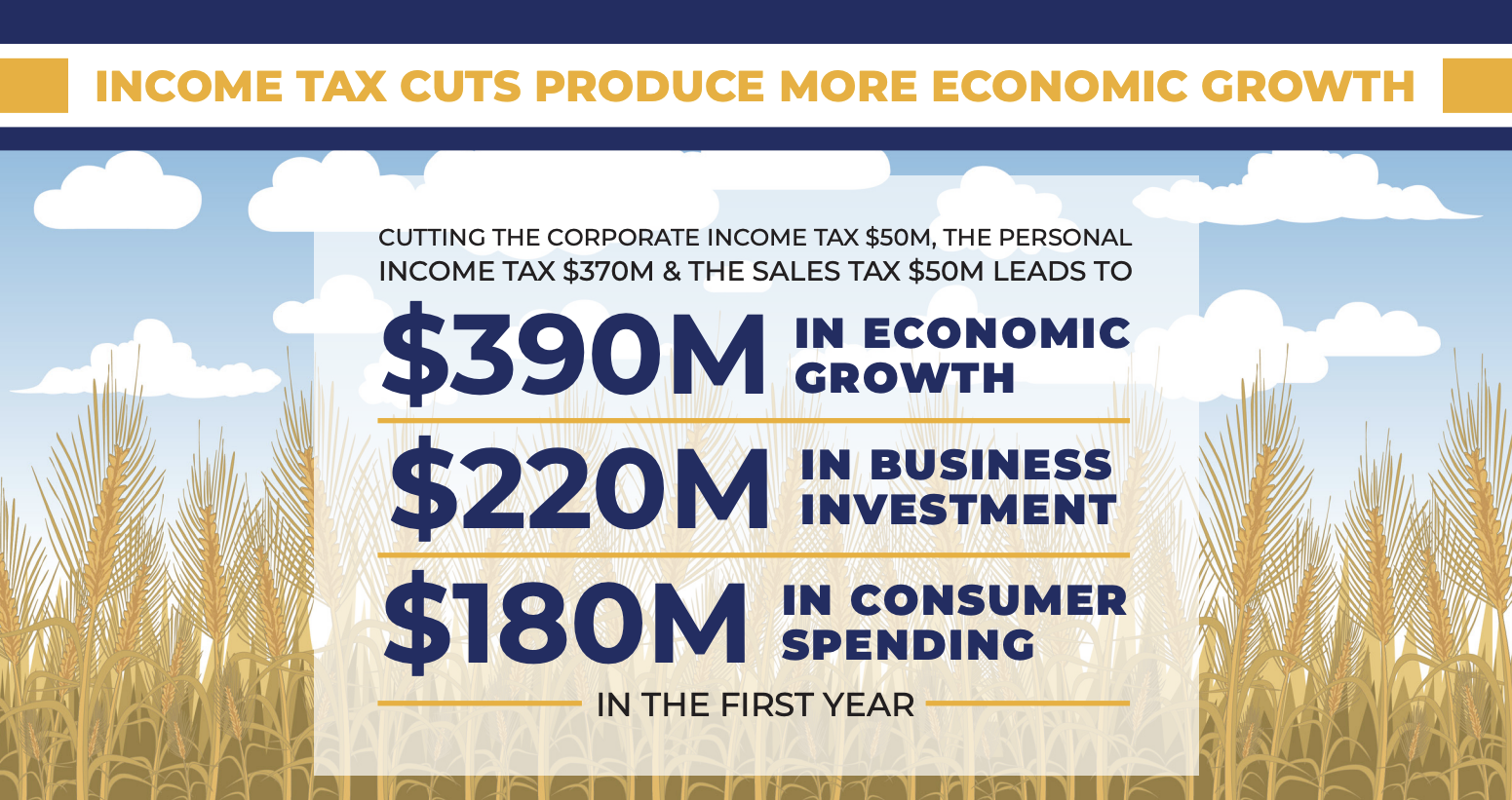

In Kansas, The Buckeye Institute showed that a $370 million personal income tax cut, $50 million corporate income tax cut, and a $50 million sales tax cut would generate:

- $390 million in economic growth;

- $220 million in business investment; and

- $180 million in consumer spending in the first year.

And The Buckeye Institute continued working in Iowa to build on a 2022 flat tax victory. Using Buckeye’s economic modeling, Iowans for Tax Relief (ITR) outlined the next steps for Iowa tax reforms that have already saved state taxpayers $1.5 billion.

The only sure things in life may be death and taxes, but The Buckeye Institute has worked in 14 states to help reduce those taxes by more than $10 billion. And we’re not anywhere near done yet.

Rea S. Hederman Jr., executive director of the Economic Research Center and vice president of policy at The Buckeye Institute.