Logan Kolas

The Buckeye Institute Offers Policy Solutions to Harness AI to Improve Healthcare

April 01, 2024

In a new report—A Healthcare World Reimagined: How Big Government Threatens Healthcare AI and What to Do About It—that is no April Fools’ Day joke, The Buckeye Institute outlines policy solutions and regulatory changes lawmakers should address to capitalize on the benefits of artificial intelligence to improve healthcare services. “Artificial intelligence, even in its fledgling stage, already shows great promise for improving healthcare services for physicians, hospital systems, and their patients.”

The Buckeye Institute: Open Ohio’s Regulatory Sandbox to All Innovators

January 10, 2024

The Buckeye Institute released a new policy brief, A Sandbox for Everything: A Universal Approach to Help Innovators, urging Ohio lawmakers to cut more regulatory red tape and “expand Ohio’s ‘regulatory sandbox’ to include all industries.” The brief outlines three improvements Ohio policymakers can take to cut more regulations and attract more innovators to the Buckeye State. “By expanding its regulatory sandbox and leading the way in creating a state-to-federal sandbox reciprocity program, Ohio will remain competitive in the innovation race.”

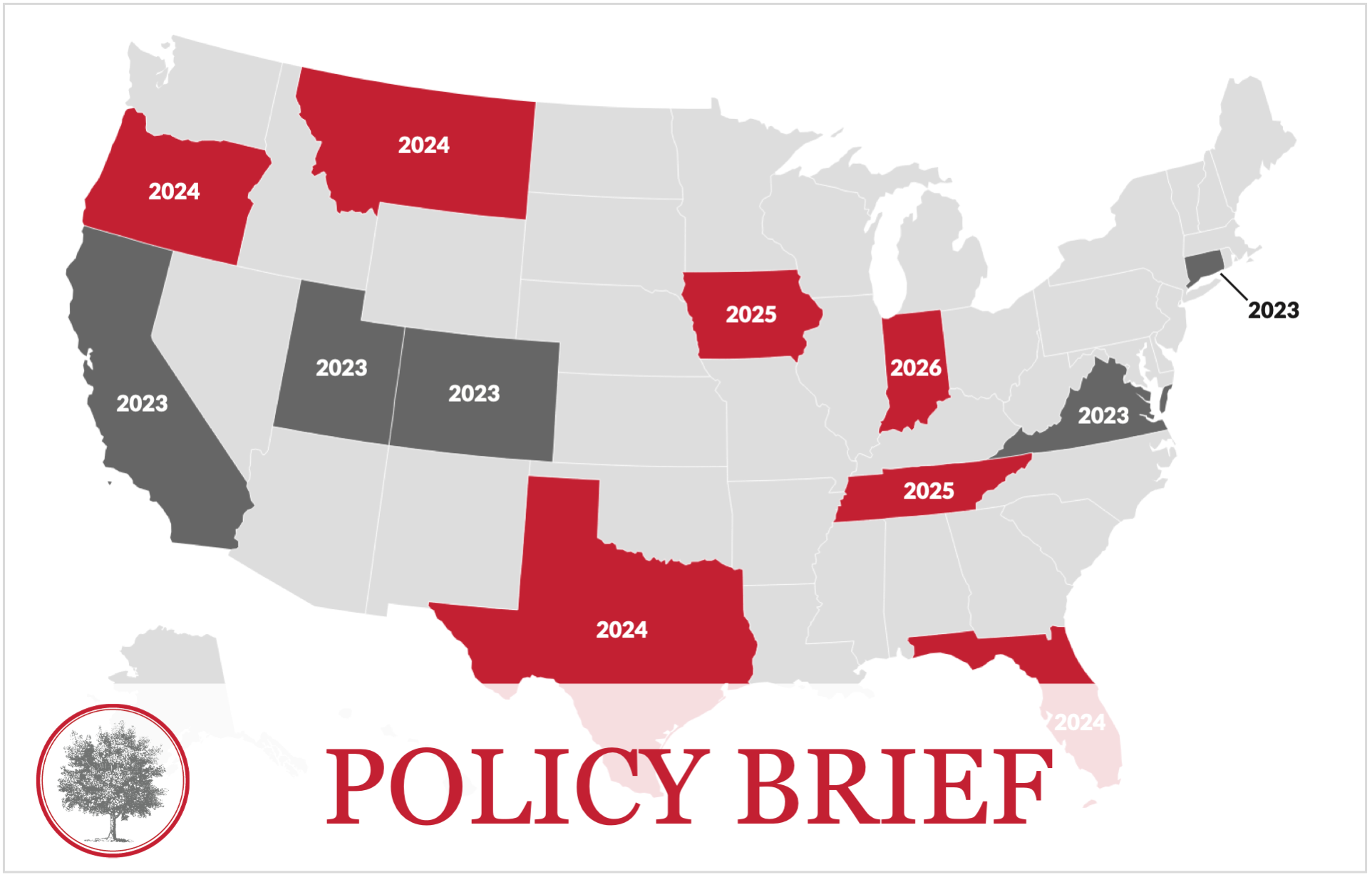

On data privacy, look to the states and not to Europe for solutions

October 13, 2023

Following the release of its new policy report, Key Principles for State Data Privacy Laws, The Buckeye Institute takes to the pages of The Hill to offer a free-market approach to data privacy laws. “More than two decades of Washington’s inaction on data privacy prove that whatever Congress may say about the subject, it cannot be trusted to pass responsible, comprehensive data privacy rules. And certainly not in time to save the country from a patchwork of ham-fisted European-style laws.”

New Buckeye Institute Report Offers Free-Market Principles to Guide States Debating Data Privacy Laws

October 12, 2023

The Buckeye Institute released a new policy report, Key Principles for State Data Privacy Laws, detailing a free-market approach states should take in passing data privacy laws and outlining the failed European approach that some states have explored. “By adopting a free-market approach and following The Buckeye Institute’s principles, states can strike a better balance between consumer protections, market needs, and regulatory burdens.”

Immersive Learning Technologies: Changing How We Live and Learn

October 04, 2023

“As a recent Buckeye Institute policy brief explains, augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies can help workers prepare and train for new jobs in advanced manufacturing—but they are also already changing the way we live, work, and learn.” The Buckeye Institute looks at how immersive learning technologies are changing how we live and learn.

New Buckeye Institute Paper Outlines Urgency of Training Tomorrow’s Advanced Manufacturing Employees Today

October 04, 2023

As America prepares to mark Manufacturing Day, The Buckeye Institute released a new policy brief, Training Tomorrow’s Advanced Manufacturing Employees Today, that outlines the urgency of equipping Ohio workers with the training and skills needed for the jobs of tomorrow. “Even as automation and technology once reduced manufacturing workforces in Ohio and across the country, new learning technologies are poised to help train those workforces for the manufacturing jobs of tomorrow.”

Help wanted: More bright minds in Dayton

September 11, 2023

In the Dayton Daily News, The Buckeye Institute makes the case for a state-based visa program that enables Ohio to attract the workers it desperately needs. “State policymakers can collaborate with federal policymakers to create a system of state-based visas to allow for more high-skilled immigrants who want to work, invent, and invest themselves in Ohio. More people, more creative minds, more motivated inventors — and more stories like the Wright brothers in Dayton.”

The Buckeye Institute: In Wake of Washington’s Failure, States Must Lead on Data Privacy

August 10, 2023

The Buckeye Institute released a new policy brief, A Federalism Opportunity in A Congressional Failure: How States Can Fix the Data Privacy Patchwork, urging states—in the wake of Congress’s failure to adopt comprehensive data privacy legislation—to work together to harmonize state-level data privacy rules, which, if left unaddressed could cost businesses and consumers $98 billion to $112 billion annually. “[S]tates can and should take the lead and pass data privacy legislation that minimizes compliance costs while effectively protecting consumer data privacy.”

The Supply Chain Case for State-Based Visas

July 28, 2023

At RealClearPolicy, Logan Kolas, an economic policy analyst with The Buckeye Institute’s Economic Research Center, calls for a collaborative state-federal effort to allow states to tailor a state-based visa program to fit their local labor markets. “[C]entral planners in Washington have failed—once again—to anticipate changing market conditions and keep pace with consumer and producer needs. A less centralized, more nuanced approach to legal immigration would give state policymakers a seat at the table to better inform federal immigration decisions.”

End the federal immigration monopoly

July 14, 2023

On Cleveland.com, The Buckeye Institute calls on Congress to end the failed federal immigration monopoly, writing, “Instead of a one-size-fits-all immigration scheme drafted inside the Beltway, the United States should design a collaborative state and federal visa program that gives states a say in admitting high-skilled workers to fill local labor market needs. This commonsense, state-based visa idea is gaining bipartisan traction across the country and here in Ohio.”