The Buckeye Institute: Policies in HB309 Will Help Lower Property Taxes

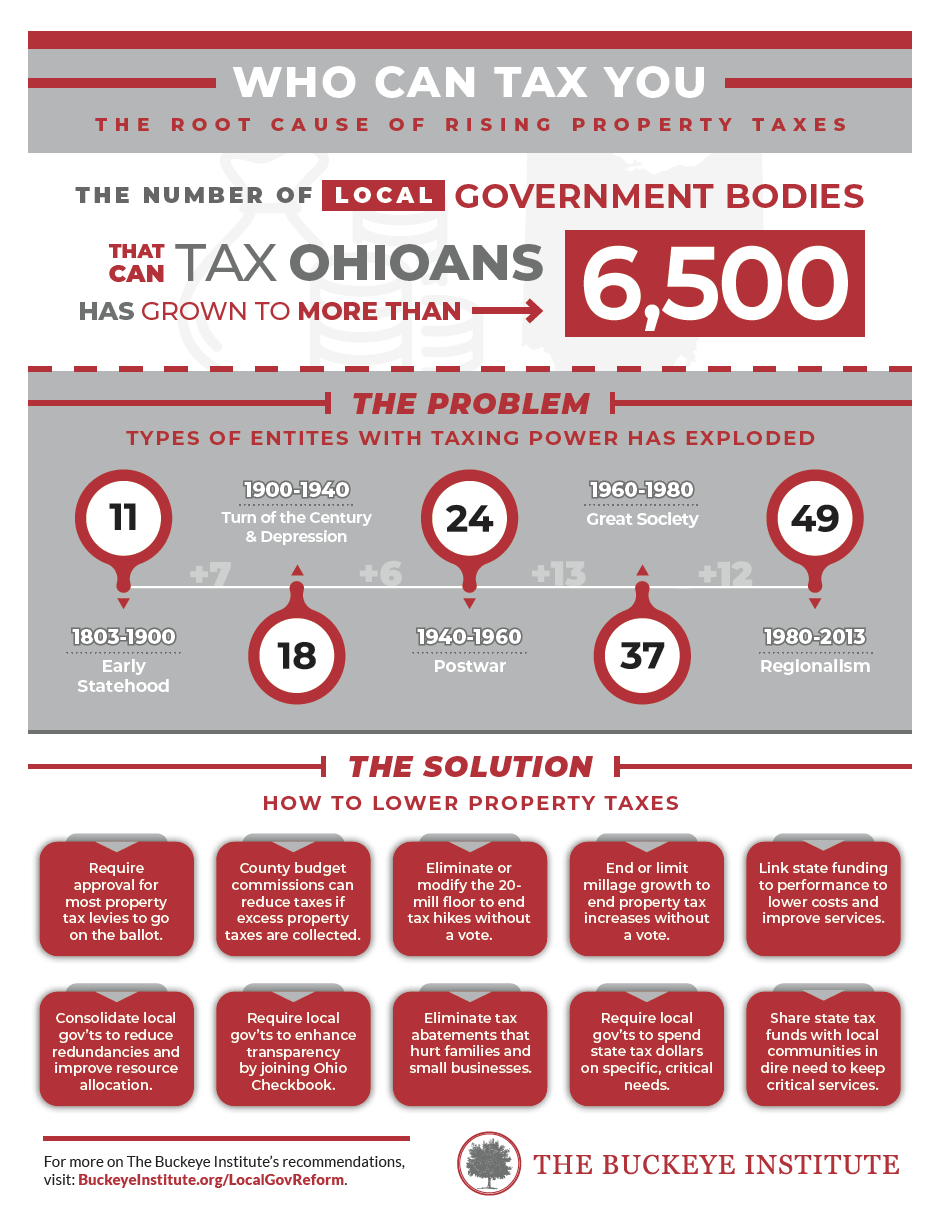

Sep 24, 2025Columbus, OH – On Wednesday, The Buckeye Institute testified (see full text below or download a PDF) before the Ohio House Ways and Means Committee on the policies in Ohio House Bill 309, which empowers county budget commissions to reduce property tax levies if those levies collect more than approved by voters. This is one of the 10 recommendations The Buckeye Institute offered to the Property Tax Reform Working Group to lower Ohio’s soaring property taxes.

In his testimony, Greg R. Lawson, a research fellow at The Buckeye Institute, noted, “House Bill 309 puts another tool in the tax reformers’ toolbox to help fix Ohio’s property tax problem.” Lawson recommended that lawmakers put some guardrails in place to “ensure that levies remain high enough to satisfy their original purposes and over-zealous commissioners do not substitute their personal tax-cutting preferences for the will of the voters.” Guardrails Lawson suggested include:

- Adopting specific metrics for gauging “revenue excess;”

- Designating periods during which commissions may cut taxes; and

- Prescribing limits on the size of tax cuts that county budget commissions can make.

Lawson closed by commending “Representative Thomas for introducing House Bill 309 and taking a step toward a more efficient local government structure and property tax system.” He urged lawmakers to do more to “ease property tax burdens by streamlining Ohio’s local government structure of more than 600 school districts and the growing list of thousands of taxing entities across the state.”

Find more Buckeye Institute recommendations to reform local government and lower property taxes at BuckeyeInstitute.org/LocalGovReform.

# # #

Empowering County Budget Commissions

Interested Party Testimony

Ohio House Ways and Means Committee

Ohio House Bill 309

Greg R. Lawson

Research Fellow

The Buckeye Institute

September 24, 2025

As Prepared for Delivery

Chair Roemer, Vice Chair Thomas, Ranking Member Troy, and members of the Committee, thank you for the opportunity to testify regarding Ohio House Bill 309.

My name is Greg R. Lawson. I am a research fellow at The Buckeye Institute, an independent research and educational institution—a think tank—whose mission is to advance free-market public policy in the states.

Ohio’s property taxes and complex municipal income tax structure imposed the 8th highest local tax burden as a percentage of income in the nation in fiscal year 2022—up from 12th in fiscal year 2021. In addition to costs and inefficiencies created by a byzantine local government system, homeowners and small businesses now routinely face unpredictable property tax spikes spurred by historic inflation levels, leading some to openly call for abolishing property taxes altogether.

House Bill 309 puts another tool in the tax reformers’ toolbox to help fix Ohio’s property tax problem. The legislation empowers county budget commissions to reduce property tax levies if those levies collect more than necessary to accomplish their goals. The Buckeye Institute supports this taxpayer protection, and unfortunately Governor DeWine vetoed it in the recent budget bill. If enacted, not every commission will choose to lower property taxes, of course, but authorizing the option gives homeowners a safety valve in jurisdictions in which tax revenues exceed expectations.

Policy guardrails may be necessary to ensure that levies remain high enough to satisfy their original purposes and over-zealous commissioners do not substitute their personal tax-cutting preferences for the will of the voters. Such protections might include specific metrics for gauging “revenue excess,” a designated period during which commissions may cut taxes, and prescribed limits on the size of those tax cuts. But the need for those manageable safeguards should not preclude the bill’s enactment.

In addition to House Bill 309, The Buckeye Institute urges policymakers to ease property tax burdens by streamlining Ohio’s local government structure of more than 600 school districts and the growing list of thousands of taxing entities across the state. As The Buckeye Institute explained last month in Crain’s Cleveland Business, “Without transformational change to Ohio’s antiquated structure, homeowners will continue to suffer rising, unsustainable property taxes.” So, even if House Bill 309 is enacted, The Buckeye Institute also recommends eliminating unfunded state mandates that force local governments to raise taxes to meet Columbus’s demands, and advocates incentivizing local governments to share or consolidate resources to reduce excessive levies as counties and municipalities look to diversify their tax bases without inside millage. Governor Kasich’s Beyond Boundaries report and The Buckeye Institute have offered guidance for consolidation and service-sharing across jurisdictions that can save taxpayer dollars and make public services more efficient. And in recent testimony to the Property Tax Reform Working Group, The Buckeye Institute itemized 10 recommendations for reforming local government and reducing Ohio’s soaring property taxes—a policy list that the editors of Crain’s subsequently advised the Working Group to “take seriously.”

The Buckeye Institute commends Representative Thomas for introducing House Bill 309 and taking a step toward a more efficient local government structure and property tax system. That step is sorely needed to protect Ohio taxpayers from an outmoded, undemocratic system that has cost them dearly for decades.

Thank you for your time and attention. I would be happy to answer any questions that the Committee might have.

# # #