Orphe Divounguy, Ph.D.

New Buckeye Institute Report Finds Occupational Licensing Hits Older and Lower-Income Workers Hardest

December 18, 2017

The Buckeye Institute’s Economic Research Center released its latest policy report, Still Forbidden to Succeed: The Negative Effects of Occupational Licensing on Ohio’s Workforce. The report found that the burden of Ohio’s occupational licensing requirements has a greater impact on middle-aged and low-income workers, and those without a college degree. In essence, occupational licensing erects barriers to employment to those most in need of good-paying jobs. “This research offers more evidence of the negative impact of occupational licensing.”

New Buckeye Institute Analysis of Ohio’s Tax & Spending Policies Offers Guidance to 2020 Commission

October 10, 2017

The Buckeye Institute released its latest policy brief, Building a Better Future: An Analysis of Ohio’s Tax and Spending Policies, which looks at the tax and spending policies Governor John Kasich and the Ohio General Assembly have adopted since 2013 and their impact on Ohio’s economic growth. “Contrary to the arguments levied by opponents of tax reform, this analysis shows that the tax reforms implemented by Governor Kasich and the General Assembly have led to economic growth in Ohio.”

The Buckeye Institute: Ohio Created More Jobs than Expected in June

July 21, 2017

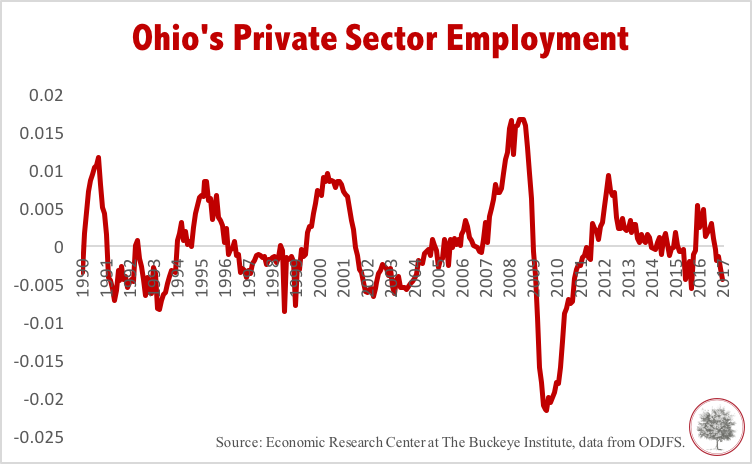

The Buckeye Institute commented on newly released unemployment data from the Ohio Department of Job and Family Services. “Last month, the civilian labor force fell slightly (-0.1%) despite a small increase in the working-age population...While job growth in 2017 has slowed, Ohio is not unique, as the state’s employment picture is consistent with the rest of the US economy.”

The Buckeye Institute: Ohio’s Economy Stuck in Neutral in May

June 16, 2017

The Buckeye Institute commented on newly released unemployment data from the Ohio Department of Job and Family Services. “This month, the number of job seekers—people entering the labor force—slowed to a standstill, with the Ohio economy creating 6,300 jobs, most of which were in the government sector. However, we shouldn’t worry yet...This may just indicate that employers are finding it difficult to find suitable workers, which could benefit job seekers as employers could raise wages to attract the right talent.”

New Buckeye Institute Report Finds Louisiana’s Proposal to Raise Taxes Will Hinder Economic Growth

June 05, 2017

A new report, Addressing Louisiana’s Budget Shortfall: Strategies for Growth, by The Buckeye Institute’s Economic Research Center, found that Louisiana’s proposal to raise taxes to finance more government spending will hinder economic activity and growth. The research, conducted in conjunction with the Pelican Institute, determined that eliminating the corporate income tax and replacing it with a revenue neutral sales tax increase creates jobs, grows the economy and increases tax revenue.

The Buckeye Institute: Employment Falls in April, No Reason to be Alarmed Just Yet

May 19, 2017

The Buckeye Institute commented on newly released unemployment data from the Ohio Department of Job and Family Services, saying, “According to the Current Employment Statistics Survey, April marks two consecutive months of employment losses. Although the private sector lost 3,800 jobs in April, private sector employment for the first four months of 2017 performed above expectations, creating only 500 fewer jobs than it did in the first four months of 2016.”

New Year, New U.S. President and Ohio's Cool-Down Continues

March 07, 2017

The Buckeye Institute’s Study on Ohio’s RPS Shows Devastating Economic Results

March 03, 2017

The Buckeye Institute’s Economic Research Center released its new report, The Impact of Renewables Portfolio Standards on the Ohio Economy, which demonstrates the negative economic impact of Ohio’s renewables portfolio standards on the state’s economy. If the renewables standards continue as shown in this new Economic Research Center study, Ohio’s economy would suffer from 134,000 fewer job opportunities and the state’s GDP will be reduced by $15.5 billion within 10 years.

Half a billion below Expectations: Ohio’s Tax Collections Shouldn’t Surprise Anyone

February 13, 2017

The Buckeye Institute’s Economic Research Center Releases New Model of Wyoming’s Economy

February 09, 2017

The Buckeye Institute’s Economic Research Center released two reports on Wyoming’s fiscal and economic problems—Review of Wyoming’s Fiscal Health and Fiscal Policy, Theory, and Measurement: The State of Wyoming. These comprehensive economic studies were conducted in partnership with Wyoming Liberty Group and analyzed both the challenges and several potential policy solutions for Wyoming’s state budget woes.